EU-UK social security protocol and its implications

EU-UK social security protocol and its implications

Fri 26 Feb 2021

On 24 December 2020, a draft protocol on social security co-ordination for EU-UK cross border working arrangements that start from 1 January 2021 was published.

The draft protocol contained an article covering detached workers, i.e. employees who normally work in one EU member state/the UK who are sent to work in the UK/an EU member state from 1 January 2021.

As a transitional measure these employees and their employers paid social security contributions to the state the employees had been sent to work from, provided that they did not work in the destination country for more than 24 months.

EU states had until 1 February 2021 to decide whether they would apply the detached worker rule, or apply the general rules, i.e. where these employees pay social security contributions to the state they have been sent to work in, regardless of the length of their detachment.

The draft protocol provided EU member states with a deadline of 1 February 2021 to opt out of the detached worker rules with the transitional rules applying until this date.

On February 2021 Mazars received written confirmation from HMRC that all EU member states had notified the EU of their intention to apply the detached worker article.

What does this mean? What are the issues employers now need to consider in respect of detached workers?

Read the full version here.

Want to get notified when new blog posts are published?

Subscribe

Moving to Mexico: global mobility tax considerations

Since 2020, as a result of the COVID-19 pandemic, Mexico has become an attractive location for certain foreigners to work remotely. However, employers have to consider numerous tax and immigration factors for their employees working remotely from Mexico. According to Mexican legislation, an expatriate is a person who is legally authorised to carry out a […]

Expert tax relief in Sweden to be more advantageous

The Government of Sweden has submitted a bill extending the period for granting expert tax relief from five to seven years. If the Government bill is approved by Parliament, the extension will be in effect for eligible employees commencing work on 1 April 2023 or later. This article explains how the tax relief works and […]

Significant changes to Dutch expat facility

On 19 September 2023, Dutch Parliament voted for several amendments to the 30%-ruling (exempting 30% of the pay of a foreign employee working in the Netherlands) from 1 January 2024. Upon the likely enactment, this will have an impact on the tax position of existing and future expats working in the Netherlands, reducing or limiting […]

Spanish Supreme Court allows tax benefit to company directors

A Spanish Supreme Court Ruling on 20 June 2022 effectively reverses the decision by the Spanish tax authorities to remove the tax exemption for company directors for works carried out abroad(1). In its ruling, the Supreme Court considers that directors and board members can apply the exemption, provided that requirements set out in Article 7.p) […]

The impact of digital assets and cryptocurrencies decentralised finance on taxation in various jurisdictions

Digital assets and cryptocurrencies continue to evolve by offering new services and products such as Decentralized Finance (DeFi) and non-fungible tokens (“NFTs”), but is tax legislation also keeping up to date with the ever-changing world of digital assets and cryptocurrencies?

India: Most Favoured Nation Clause causes controversy

India has signed double tax avoidance agreement (DTAA) treaties with several countries and entered into a protocol, inter-alia, containing the Most Favoured Nation (MFN) clause with 13 countries including France, Belgium, Spain, Sweden Switzerland, and the Netherlands. The MFN clause usually states that if, after date of entry into force of the tax treaty between […]

New tax rules in Luxembourg impacting cross-border workers and PEPPs

Guidelines on the taxation of cross-border workers during the Covid-19 pandemic and an update on PEPP as defined in the latest budget laws in Luxembourg.

Changes to Belgian special tax status expected in 2022

The Belgian government has approved a draft bill in which changes for the new Belgian special tax status for foreign executives and specialists are embedded. The limited duration of the tax benefits, the minimal remuneration threshold, and the ‘30%-rule’ are the most profound changes. The changes will be effective from January 1, 2022. As a […]

Greece’s beneficial tax regime for foreign residents

In December 2020, Greece introduced tax incentives to attract foreign tax residents. Specifically, the provisions of Article 5C of the Greek Income Tax Code (ITC), which came into force on 1 January 2021, stipulate that foreign employees or foreign freelancers becoming Greek tax residents can enjoy a 50% tax exemption from income derived in Greece […]

Improved tax flexibility for Belgian / Luxembourg cross-border workers

Due to the Covid-19 pandemic, many Belgian tax residents working in Luxembourg were no longer able to travel since remote working/home working was recommended or mandatory, based on governmental rules. As such, ‘the 24-day rule’ (whereby taxation of days working in Belgium are treated as fully taxable in Luxembourg and not in Belgium, provided the […]

Impact of the UK’s new Health and Social Care Levy Bill on expatriates

In response to the unprecedented spending on public services during the recent pandemic, the UK government has introduced a 1.25% health and social care levy applicable to every person liable to National Insurance Contributions (NIC), including self-employed individuals and internationally mobile employees (IMEs). Where employees are concerned, employers will also be required to pay the […]

Recent Tribunal ruling on the taxation of ESOPs (Employee Stock Option Plans) in India

In accordance with OECD guidelines, the taxability of ESOP in India depends on where employment is exercised and the period of service for which ESOP has been granted.

Tax aspects of opening a business hub in Asia

The Asian Development Bank has forecast that developing Asia’s growth is forecast to rebound to 7.3% in 2021 and 5.3% in 2022. This compares to 4.2% and 4.4% respectively for Europe (see here) and 6.9% and 3.6% for the US (see here). Businesses already with a footprint in the Asian region will be gearing up their operations to deal with the region’s expected […]

Migrants and refugees have employment rights and obligations in Uruguay

As Covid restrictions begin to lift there will inevitably be increased movement of workers across borders. This brings back into focus a range of global mobility and tax considerations for businesses and individuals. Examples include work permits, visas, payroll and social security amongst other issues. Below is a snapshot of some pints concerning Uruguay to […]

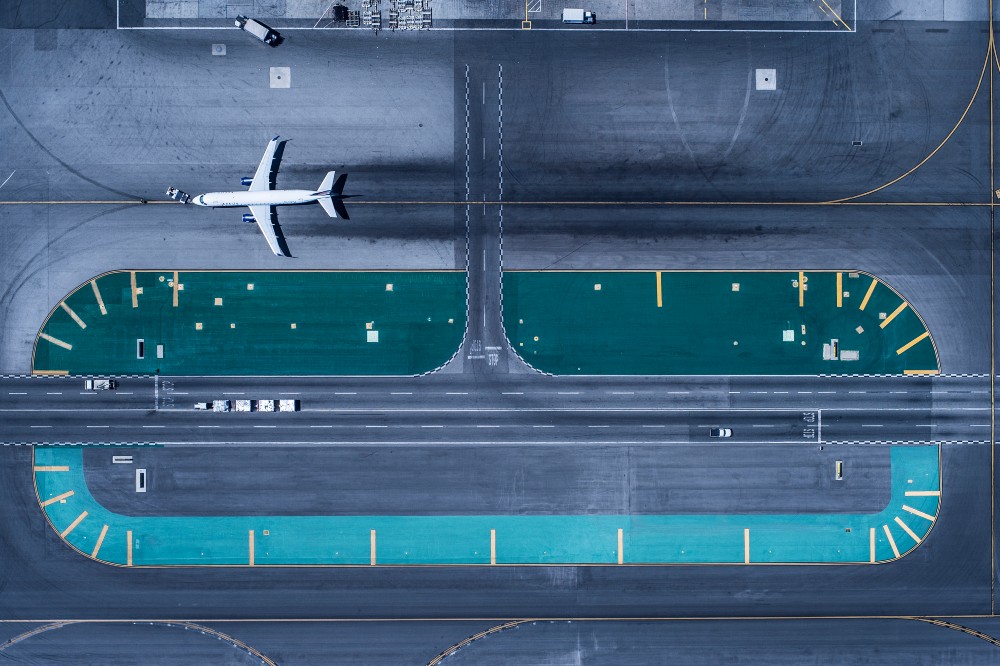

Challenges of global mobility – focus on Mauritius

Global mobility is a significant advantage in a world where all countries are connected by monetary flow, means of transports and digital communication. A comprehensive global mobility strategy takes time, teamwork, and careful thought. The main challenges faced when designing a global mobility program are payroll, tax issues and laws, and compensation among others. It […]

Updated OECD guidance on the impact of Covid-19 for cross border workers

In April 2020 the OECD issued guidance on the impact of Covid-19 on double taxation agreements (DTA) and their application to cross border workers. In January 2021 they updated this guidance. This guidance is necessary as some cross-border workers have been stranded in a country that is not their normal residence, and double taxation could arise without applying a practical approach to the […]

Why Czech Republic’s tax system is attractive for expatriate employees?

Tax reform continues to come in waves across the globe. One common theme of many reforms is tax breaks for low to mid wage earners and surprising tax hikes for high wage earners. This trend seems to be consistent with the latest out of the Czech Republic. New changes to the Czech tax law effective […]

Impact of Covid-19 on personal income tax and permanent establishments in Singapore (Part 2)

The Covid-19 pandemic has resulted in unprecedented disruptions across multiple countries and economies in the world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses. This article provides an insight into the tax considerations in respect of the current crises with focus on the Singaporean personal income tax regime and the possible creation of permanent establishment risk. Permanent Establishment considerations […]

Impact of Covid-19 on personal income tax and permanent establishments in Singapore (Part 1)

The Covid-19 pandemic has resulted in unprecedented disruptions across multiple countries and economies in the world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses. This article provides an insight into the tax considerations in respect of the current crises with a focus on the Singaporean personal income tax regime and the possible creation of permanent establishment risk. Taxation […]

Covid-19 and the impact on taxation of individuals and permanent establishments in Nigeria

world. In addition to adversely affecting the world economy, the restrictions placed on travel could have personal income tax implications for individuals and permanent establishment risks for businesses.

Remote Worker – “necessity” or “choice”?

During the first wave of Covid-19 back in the spring of 2020, many employers found themselves dealing with the issue of “remote workers” in significant volumes, for the first time. When “working from home”, means working from home in another part of the city or the country then the issues are more likely to be […]

Welcome (bienvenidos, willkommen, karibu, bienvenue) to a world of tax incentives

The pandemic has led to many people choosing to relocate. Many are leaving densely populated cities to work remotely to where they feel are more desirable locations for themselves and family. Others are holding steadfast to their crowded city dwellings. Either way, geographies are challenged to retain (or welcome) existing residents and newcomers. Many are […]

The new year brings new social security challenges post- Brexit

What is the issue? With Brexit talks still ongoing, employers should be planning for the impact of a hard Brexit on social security coverage and benefit provision for their employees who travel between the UK and EU (including EEA & EFTA countries and Switzerland) for work. HMRC’s October employer bulletin provided a welcome update on […]