Mexico’s preferential domestic manufacturing regime for export supply chains

Global R&D tax incentives

Mexico’s preferential domestic manufacturing regime for export supply chains

Thu 28 Jul 2022

Did you know that in Mexico you can have a branch or a manufacturing relationship with a Mexican company in which the manufacturing process can be performed using your machinery, equipment, and inventory without the tax exposure of a permanent establishment and under a preferential customs regime? Below we’ll explain more about this tax regime, which could help you to expand your operations in America.

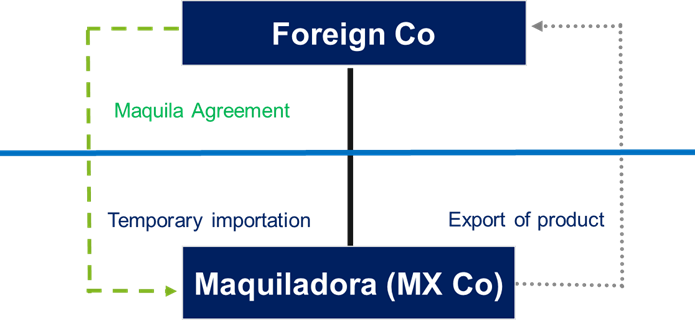

Foreign residents are allowed to have legal or economic relationships (through a Maquila agreement) with Mexican residents regarding their manufacturing operations for processing goods or merchandise using assets they provide, without being considered to have a permanent establishment in Mexico if a treaty to avoid double taxation exists and transfer pricing rules are complied with.

Maquiladoras can be set-up under different categories:

- Controller – Where one entity in a group controls a program involving other entities of the group as controlled entities.

- Shelter- Whereby an entity participates with foreign partners that provide technology and production materials, but which are not engaged in operations.

- Industrial- For entities that perform goods manufacturing or assembly processes for export.

- Service- For entities providing services related to the processing of goods for export.

- Outsourced contract- For entities that do not have the facilities to perform production processes and subcontract them to third parties.

Most Maquiladoras have the following structure:

Maquiladora Requirements

Maquiladora operations must meet the following requirements:

I. A contract manufacturing agreement must be made, under a Maquila Program, in the terms of the IMMEX (“Programa de la Industria Manufacturera, Maquiladora y de Servicios de Exportación” in Spanish), using which goods are temporarily imported, subjected to a transformation or repair process, and then returned abroad.

Goods can be owned by a foreign company when it has a business manufacturing relationship with another foreign resident that has a Maquiladora agreement with its Mexican subsidiary.

II. All income from production activities must come from the maquiladora operation. However, additional revenue is allowed, as long as it does not exceed 10% of the total maquiladora income during the year. Such revenue may come from administrative or technical services, the sale of scrap or waste, the sale of fixed assets, the subletting of space in its own or rented warehouses, among others.

III. When permanently imported goods are included in the production process, these goods must be exported together with the temporarily imported goods.

IV. Transformation or repair processes must be performed using machinery and equipment at least 30% of which is owned by the foreign resident.

Transformation and repair processes may be supplemented with machinery and equipment owned by a third party residing abroad if it has a manufacturing relationship with the foreign resident that has a toll manufacturing agreement with the Mexican enterprise, or using machinery and equipment owned by the Mexican enterprise; or with machinery and equipment leased from an independent party.

Corporate Taxable Profit Benefits

-The foreign resident is considered not to have a permanent establishment in Mexico arising from the inventory, machinery, and equipment kept in Mexico and owned by the foreign resident, as long as a Maquila agreement is in place.

-Minimum taxable profit based on Safe Harbour calculation. Maquiladora operations comply with transfer pricing rules when the highest amount resulting from the two options below is reported as their taxable profit:

I. 6.9% of the value of the assets used in the toll-manufacturing operation during the fiscal year, including those owned by the Mexican enterprise and the foreign resident; or,

II. 6.5% of the total operating expenses and costs incurred by the Mexican enterprise, including those covered by the foreign resident.

-By presidential decree, the benefit of deducting 100% of payments to employees that are usually fringe benefits and that are exempt for the individual for income tax purposes, is only given to the Maquiladora. This represents an additional deduction of 47% or 53% (depending on the specific calculation) of tax-exempt employee income compared to business taxpayers that are not in the Maquiladora regime.

Advance Pricing Agreement (APAs)

As a result of the 2022 tax reform, enterprises that perform Maquiladora operations can no longer use the APA alternative in order to comply with transfer pricing rules; Safe Harbour being the only remaining option.

Those enterprises with an APA filed during the 2021 fiscal year, prior to the current tax reform, that is awaiting a response from the tax authorities, will be covered for the tax years from 2020 to 2024, when the final decision is made by the tax authorities, after which they will have to comply using the Safe Harbour methodology.

The inability for ‘Maquiladora companies’ to access an APA (so that they only have the option of the safe harbour rules mentioned above) could result in a considerable restatement and resulting surcharges.

Profit Sharing

Maquiladora companies are required to pay mandatory profit sharing to their employees, except for the directors, administrators, and general managers. All staff are entitled to profit sharing. Profit sharing is calculated on an annual basis and represents 10% of the net taxable profit generated by the Maquiladora. In 2021, the government established a maximum limit to the amount of profit sharing to be paid, which now has to be the equivalent of three months’ salary or the average profit sharing paid in the last 3 years, whichever is higher.

Customs

The IMMEX program is a tool that allows the temporary importation of goods used in an industrial process or service for the manufacture, transformation, or repair of foreign goods for their subsequent exportation.

The payment of 16% Value Added Tax (VAT) on temporary importations can be avoided if the Maquiladora applies for a VAT certificate. This certificate will be granted if the Company can prove its level of compliance with tax and foreign trade regulations.

It is possible to temporarily import goods that are used in an industrial process or service for the manufacturing, transformation, or repair of foreign merchandise without paying the General Import Duty.

Conclusion

Operating in Mexico using a Maquiladora scheme is a great opportunity for foreign investors looking to expand or grow their manufacturing processes. It should be noted that in order to operate as a maquiladora the goods subject to a transformation must be exported or transferred to another Maquiladora that is part of a supply chain.

In addition to the benefits mentioned in this article, Mexico is the Latin American country with the largest number of tax treaties and it has a privileged location in the center of the American continent that can be used as part of a supply chain with other sites in the region.

Today, Mexico has a solid Maquila Industry focused mainly on the automobile, manufacturing, and aerospace sectors. If you are interested in exploring this special regime with Mazars Mexico, we already have numerous clients operating under this regime and years of experience in helping foreign companies to set up a maquiladora in Mexico.

Want to get notified when new blog posts are published?

Subscribe