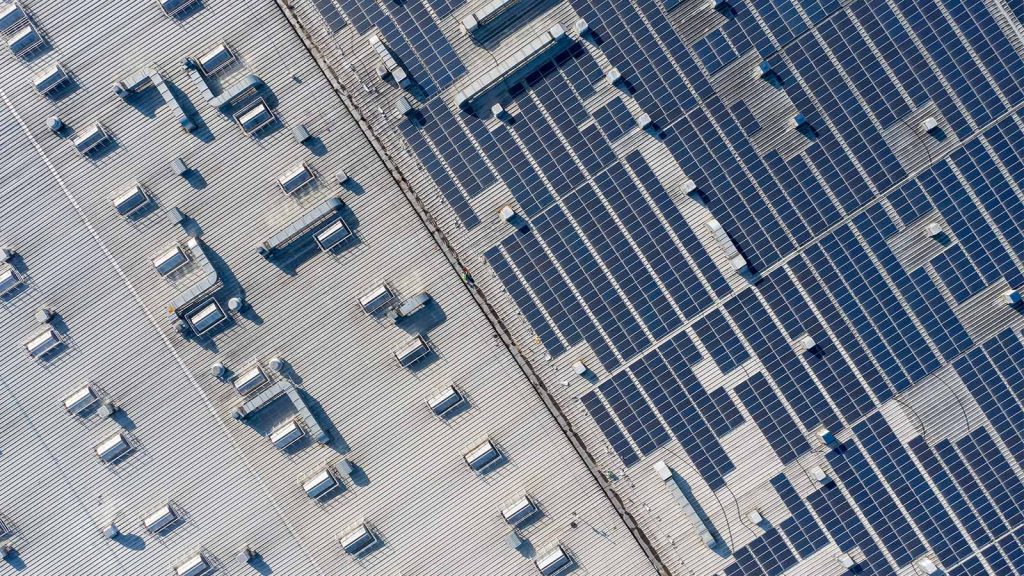

Q3 2022 quarterly valuation update for the energy and infrastructure sector

Energy Transactions

Q3 2022 quarterly valuation update for the energy and infrastructure sector

Wed 16 Nov 2022

Welcome to the Q3 2022 edition of our quarterly valuation update, which provides a snapshot of some of the main publicly available valuation trends across the energy and infrastructure sector, covering both debt and equity metrics.

This quarter we continue to look at trends in debt and equity metrics relying primarily on publicly available information. In relation to the equity trends, we use the Mazars indices of listed infrastructure funds and listed renewable energy funds, compiled on the basis set out in Appendix 1 to this update.

In addition, this quarter we have included a spotlight on valuing assets in uncertain times, highlighting listed renewable energy and infrastructure funds.

Three key themes from Q3 2022:

Q3 has been characterised by a material and dramatic rise in the cost of debt. A surge in gilt rates caused by inflationary pressures, has led the overall cost of debt to be materially higher. At the end of Q3, this was purely reflecting higher swap rates with margins more consistent.

Upward pressure on discount rates despite sustained high demand in energy and infrastructure sector. Notwithstanding the robust market appetite for infrastructure and energy assets, a combination of macroeconomic factors, higher volatility, and increased risk have started to drive transactional discount rates higher across the sector.

Asset valuations are not immune from changes to the wider economy. But history shows that the impacts are often indirect and take time to appear. The impact on discount rates tends also to be much smaller and more measured than underlying changes to the cost of debt or share prices might imply. In times of uncertainty, whilst share prices tend to be volatile, asset valuations have proven much more stable, with only incremental changes to discount rates and other valuation drivers offsetting these changes. This has been true also of the most recent period of market volatility. However, we are now seeing some clear signs of modest increases to equity discount rates in response to the higher cost of debt.

Download our quarterly valuation update for Q3 2022

To see the previous valuation update, go here.

Watch the webinar

Hear from Julian Macmillan, Director, and Ben Morris, Partner, specialising in valuations for energy and infrastructure assets, as they share their perspectives on the latest market developments and how investors and asset managers have responded.