The Technicalities of CJRS Claims – Hours vs. Days

CJRS

The Technicalities of CJRS Claims – Hours vs. Days

Wed 09 Sep 2020

Update 12 September – Since this article was originally published on 9 September, HMRC has updated its guidance in relation to Flexible Furlough and calculating CJRS claims when an employee permanently returns to work normally during a claim period. Therefore this article has been amended in the relevant sections below.

Since 1 July, the terms of the Coronavirus Job Retention Scheme (CJRS) changed, following the introduction of Flexible Furlough. Many have titled this as “CJRS v2.0”.

Broadly, this has meant that you can only continue to claim the furlough CJRS support for those employees who:

- Have already previously been furloughed for at least a consecutive period of 3 weeks, so they will need to have been sent on furlough before 11 June 2020 (unless on parental leave or returning from military leave and certain other requirements have been met); and

- Were included in a CJRS claim for a period prior to 1 July 2020 that was submitted prior to 1 August 2020.

Since 1 July, the three consecutive week requirement for a period of furlough to be capable of being included in a CJRS claim has been removed. Thus, claims can now be made for those qualifying employees who are furloughed flexibly – i.e. furloughed for periods shorter than a consecutive period of three weeks. It is good to remember that during the period of furlough the employee is not allowed and cannot do any work whatsoever at a time when they would normally be working.

Given this change in guidance, a change in calculation methodology was introduced to help employers calculate the CJRS claim for those employees who were furloughed flexibly. The calculation mechanism and methodology for flexible furlough is not straightforward to apply and requires an assessment of “usual hours” versus actual hours worked in the claim period to establish the amount that can be claimed via CJRS. However, if the employee is on ‘full furlough’, employers can still calculate the claim using days (and using the guidance that applied for the period before 1 July 2020).

HMRC has been constantly updating its step by step guidance to support those who are claiming so they can get it right. This has made it even harder to navigate, particularly as HMRC’s calculator has updated many times too and still doesn’t cover every scenario. A decision you made a few weeks ago may now not be quite as first indicated on HMRC’s calculator as subtle changes may have meant the results it produces are now different.

A technical scenario

One aspect that is causing some concern is how you calculate a CJRS wage claim for an employee who permanently comes off full furlough during a claim period post 1 July? Do you use Hours or Days?

For completeness, a claim period is the length of time that the CJRS submission covers. Typically this has been calendar months for most businesses (e.g. 1 – 31 July).

Looking at the most recent HMRC guidance, it would seem that a Flexible Furlough Hours calculation needs to be performed even where the employee was never legally flexibly furloughed.

HMRC’s recent guidance says “An employee is fully furloughed if they do not do any work for you during the claim period.” This can be found here – https://www.gov.uk/guidance/steps-to-take-before-calculating-your-claim-using-the-coronavirus-job-retention-scheme#usual-hours.

This also then creates issues around what you do with holiday leave in the claim period when the employee’s full furlough has come to an end and they are back at work normally during the claim period. However, HMRC’s update date on 11 September, taking effect from 14 September mean that you would not count time on annual leave as furloughed hours after the individual has returned to work normally during a claim period. It seems our original article may have contributed to HMRC further reviewing the interaction of claim periods, furloughed time and returning to work permanently.

Whichever approach is taken, it is important to consider the employment law interactions here and the intention behind the furlough – is the employee still on their original “full” furlough agreement and what do the employer and employee understand about their furlough?

Exploring the scenario further – An example

An example is set out below to help establish the devil that is in the detail:

- Employee furloughed from 1 April

- Employee on same furlough agreement throughout

- Employee furlough finished permanently on 12 July and returns to work normally on 13 July

- Employee has annual leave 21-24 July

- Employee paid £3,125 per month

- Employee is in pension scheme and aged 28.

- Claim period is 1-31 July

- Claim made post 14 September

Normal day calculation

CJRS furlough claim is

- £3,125 x 80% = £2,500

- £2,500 x 12/31 = £967.74

Therefore £967.74 would be claimed (plus corresponding NIC and pension amounts).

Usual hours calculation

CJRS furlough claim is:

- 40 hours per week (8 hours a day Monday to Friday)

- Usual hours = 178 hours for the July claim period (rounded up)

- Employee returned normally and therefore had three working weeks so “worked” 120 hours

- Therefore furlough hours = 58

- CJRS furlough claim = £2,500 / 178 x 58 = £814.61 (plus corresponding NIC and pension amounts)

This leaves a difference in claim of over £150 (£967 rather than £814) if you calculate using Days rather than Hours for the Claim Period, plus it also means extra has been claimed for NIC and Pension support.

However, following 11 September update, for any claims made after 14 September, you would calculate as follows:

- 40 hours per week (8 hours a day Monday to Friday)

- Usual Hours (40 hours divided by 7 days multiplied by 12 days) = 69 hours (rounded up from 68.57).

- Employee was fully furloughed up until 12 July

- Therefore furlough hours = 69

- CJRS claim using HMRC’s calculation would be £2,500 / 69 x 69 = £2,500

- However, this cannot be right as only furloughed for a portion of the claim period;

- Therefore, you would need to apportion for Days first and then apportion for Hours

- Therefore, it would be £2,500 x 12/31 x 69/69 = £967.74, leaving you with the same answer as Days – rendering whole Hours vs Days debate irrelevant!

However, if prior to 14 September you had made a claim that built in the holiday as HMRC state:

You can claim for an employee who is on:

- annual leave

- leave taken on account of time worked under a flexible work time arrangement (flexi-leave)

- family related statutory leave

- reduced rate paid leave following a period of family related statutory leave

Any time they are on these types of leave while flexibly furloughed counts as furloughed hours and does not count as time actually worked.

The calculation then becomes

- Furlough hours = 90 (as 32 hours 21-24 July, 58 + 32)

- £2,500 / 178 x 90 = £1,264.04

This is almost £300 higher than the Days calculation, and would be even higher when you add in the corresponding NIC and Pension support. Would HMRC then think you have claimed too much? Seemingly, HMRC has now answered this question by making a change from 14 September to its guidance which require employers to “only calculate the employee’s usual hours up to the last day of furlough, instead of to the end of the claim period”.

This means that you would not look at holiday after the furlough has come to a complete end during the claim period. HMRC has stated that this amendment is effective from 14 September, meaning that any claims you have made up to 14 September do not need to be amended or corrected in future claim periods – HMRC accept that your claim was accurate based on the guidance available at the time.

What would you do?

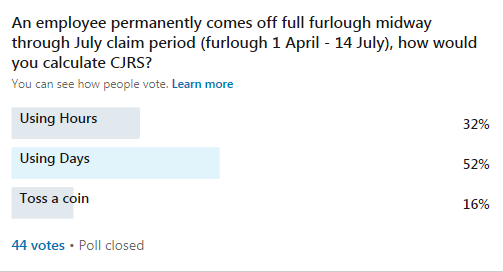

In a poll that Ian Goodwin, a Director in our Employment Tax team, conducted on Linkedin, the results were as follows:

This poll results show that many respondents consider Days to be the most appropriate approach to this specific scenario, not Hours, on the basis that the furlough is not and has never been flexible from either the employee or employer perspective.

Since HMRC’s update on 11 September, Days would be the most appropriate and correct way to manage and apportion the claim, as showed in the examples above as HMRC’s update now means the Hours vs Days debate has some better clarification, albeit it remains complex to fully comprehend given the number of updates and changes on this area!

Alternatively, you could manage the risk differently. Another method here (depending on context) would be to have shorter claim periods that follow on from each other so that the employee is fully furloughed for a claim period 1-12 July and is then not included in the claim period 13-31 July. This would mean the employee is fully furloughed for the entire claim period 1-12 July. This can be much more difficult to manage where you have lots of employees on furlough and different variables within a calendar month.

The considerations would be different if the employee was working normally from 1-4 July then went back on furlough from 5-31 July. In this scenario a Flexible Furlough calculation would need to be performed as the employee was not on full furlough at the start of the Claim Period, and the furlough characteristics are very different here. However, it will be vital for employers to check their CJRS and furlough governance by reviewing agreements and understanding in place between all parties.

How would HMRC interpret this?

Based on discussions and correspondence with HMRC inspectors, HMRC has informed us that their understanding of this specific scenario is as follows:

- Highlights the individual is fully furloughed; and

- has never been flexibly furloughed; and

- will return to work permanently once their furlough comes to an end;

HMRC then explained that the key will be considering the agreement and the understanding that is in place with the employee. On the basis that a full furlough agreement is in place, HMRC stated that they would not challenge a “Days” calculation given that this would fit the facts of the furlough arrangement and seems more obvious, despite the employee not being furloughed for the entire claim period set by the employer (due to using calendar months).

Following the recent update, and working through a practical example, it does seem that HMRC is now fully in agreement that a Days assessment is required for this very scenario!

It is interesting though that HMRC’s examples do not consider this scenario at all. Therefore, when evidencing the basis for calculations to support CJRS claims, being able to demonstrate robust governance and application of available HMRC guidance is vital in managing your compliance.

As above, HMRC inspectors appear to be taking a practical view on CJRS compliance. They are more interested in deliberate and careless errors around whether individuals have actually been furloughed or where the CJRS claim process has been abused. This was outlined by Jim Harra, the Chief Executive of HMRC who told the Public Accounts Committee on Monday 7th September 2020, “What we have said in our risk assessment is we are not going to set out to try to find employers who have made legitimate mistakes in compiling their claims, because this is obviously something new that everybody had to get to grips with in a very difficult time” (https://www.bbc.co.uk/news/business-54066815).

HMRC consider that over £3.5bn has been claimed incorrectly and will be focusing their energies on those that have not used/claimed CJRS in the spirit that it was intended. This has been highlighted recently with more arrests made for furlough fraud – no details have yet been provided in how the fraud was committed.

Preparing for HMRC’s review of submitted CJRS claims

HMRC has now started to review claims, and we are aware that there will be a disclosure email / portal made available from mid-September to help employers put things right more efficiently. We expect further updates on shortly.

If you have received any correspondence from HMRC, the following approach is recommended:

- Check with an adviser that the correspondence is not a scam – there are many CJRS scams currently being identified and it is best checking that it is legitimate;

- Review a sample of claims made to establish if there is an issue with any aspect of your calculation methodology

- Review your CJRS governance activities and document your findings

- Update any areas that need clarification / more robust documentation; and

- Make any disclosures to HMRC before 20 October to avoid any penalties.

To reiterate, this is a very technical area and on the basis that HMRC “will not decline or seek repayment of any grant based solely on the particular choice of pay calculation, as long as a reasonable choice is made”, we would suggest that keeping clear records and demonstrating the prudent approach taken will help support the claim amounts received and reduce the risk of HMRC challenges being successful.

Next steps

We are helping employers review their claims and put in place clear governance documentation to help them demonstrate to HMRC and any other third parties the controls in place and approaches taken.

If you would like us to support you, please do let us know by contacting Ian Goodwin, Employment Tax Director at Ian.goodwin@mazars.co.uk.