US election update: Two lessons for investors

Economics

US election update: Two lessons for investors

Thu 05 Nov 2020

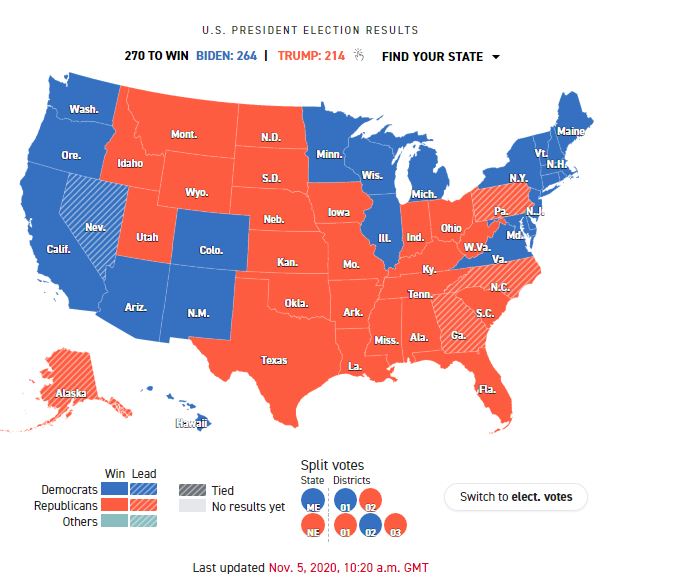

At the time of writing and bar huge surprises, it is very likely that Joe Biden will become the 46th President of the United states. Mr. Biden needs 6 more electors (6 in Nevada and 20 in Pennsylvania could go his way), and he also needs Mr. Trump’s court challenges to fail. Early Supreme Court decisions have suggested that ballots cast under existing rules would count. Experts look to Chief Justice John Roberts and Justice Brett Kavanaugh as the swing voters.

The election is almost, but not, over and there are significant lessons for investors.

Lesson No 1: How to deal with polling

Identity politics is a crutch used by pollsters when predicting votes. Latin Americans vote for X, African Americans for Y, men without a college degree for X, women with a college degree for Y and so on and so forth. This is where SAMPLING comes from. But in times of an economic recession and a global pandemic, other things may matter as well. If, for example candidate X convinced Y’s voters that Y would proceed with a national lockdown, causing massive job losses and small businesses to shut down, isn’t it likely that people would decide on the threat of their immediate livelihood above whatever political conviction? What if another message hit home? If Florida and the Rust Belt were a surprise, I believe that’s the place where the first post-mortems will be conducted.

L1: Don’t write pollsters a blank check.

Investors should neither dismiss or a priori believe polling

but rather conduct their due diligence, like with any fund:

Did the pollsters ask the right questions? Were samples representative enough? What is the trend and has it changed? While that information hasn’t always been available, I suspect that in the near future, to get any traction, pollsters will have to be a lot more open with their methodologies.

If one can’t answer those questions and still trade on an outcome, then one is not trading but betting. This much should be clear by now. Longer term investors see all these of course like storms in a tea cup, which is why we are happy our portfolios have been positioned that way.

Lesson No 2: How to approach political risk

The Democratic strategy was simple: Let Mr. Trump do all the talking. This is a great defensive strategy to win. Research showed that more people disliked what the incumbent had to say than not. But while a defense may often win games, it is hardly ever trusted as a purveyor of landslides. In hindsight, I have to admit, that the election was close shouldn’t have surprised anyone. Would Mr. Johnson have won the 2019 election by such a big margin, if Mr. Corbyn was doing all the talking?

But this election proved something even much more important: That an idle assumption of established political structures that most of the electorate liked “politics before populism” and somehow people were fooled temporarily, only to come to their senses a few years later, was shuttered. 66 million people in the world’s oldest democracy don’t believe in previous status quo. Ignoring them is not a strategy that can work anymore.

Their concerns need addressing. And because most of those concerns start with their economic welfare, a new President will have to answer: Where can I get growth from?

Mr. Trump had asserted “from others”. For a year or two that worked. Ultimately however, mercantilism didn’t produce any meaningful gains for the US economy.

So if not from others, then from where? ‘Tis the conundrum to be answered. But it will not be simple. It will require that very old parties will acquire a very new way of seeing the world.

Investors should make no mistake. Mr. Biden has described himself as a “transitional” President. The race for the Presidency begins anew on the 21st of January 2021 and I suspect it will be the most important in decades. For the past few years, candidate lineups not only in the US but for most of the western hemisphere have often been, to say the least, uninspiring.

In our representative republics, political parties are the mechanisms that produce two of three branches of power, the executive and the legislative. So it is in these mechanisms that we should look to for change before anywhere else. Not only US Democrats, but Republicans and Tories and Labour and parties across Europe need to search deep in their bench and bring out candidates that can shatter norms AND unite at the same time, to keep democracy and dialogue intact.

L2: See change or apply a premium.

Investors should be on the lookout for such introspection by traditional parties. They now have had ample warning. If ground-breaking change doesn’t occur, then even long term investors should put a geopolitical premium on their required rates of return for risk assets.

Comments