China’s Fifth Plenum: A Bridge Over Troubled Water?

Thought Leadership

China’s Fifth Plenum: A Bridge Over Troubled Water?

Fri 13 Nov 2020

During their youth, everyone is asked the much-dreaded question – ‘where do you see yourself in five years?’ or ‘what’s your five-year plan?’ the answer to which is never easy. Though, the answer certainly helps to determine how serious the person is about their future and the direction in which they’re headed.

A couple of weeks ago, China sought to answer this exact question; to inform the world of its five-year plan and how serious it is about becoming the world’s largest economy. This year, the semi-annual gathering of China’s top leaders had a special task: finalising the blueprint for the 14th Five-Year Plan, which will set China’s economic and social policy vision for the period from 2021-2025.

While leaders triumphed and celebrated achieving the goals set out in its previous five-year plan, they also acknowledged that China still faces some problems, including persistent inequality between rural and urban residents, environmental issues, and – despite a heavy government focus – a lack of quality innovation. The next five-year plan aims to tackle these issues.

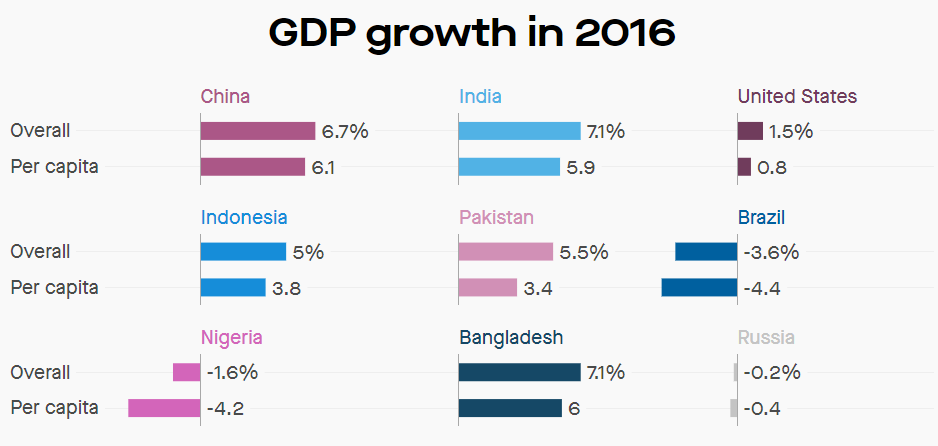

This time, there was a heavy emphasis on achieving “sustained and healthy” growth during the next five-year period. China has always pushed for its gross domestic product (GDP) growth to match developed nations like the United States. While no specific target for GDP growth was announced, the focus seems to be on improving GDP per capita instead. Why is GDP per capita so important? Growth of a country’s GDP indicates an increase in the value of all the goods and services a country produces each year, whereas GDP per capita acts as a metric for determining a country’s economic output per person living there. For countries where the population isn’t growing much, the difference between GDP per capita growth and total GDP growth is minimal. But for countries with rapidly growing populations, like China and other parts of South Asia, reporting GDP growth can be highly misleading. In 2016, for example, overall GDP growth versus per capita GDP growth for the nine most populous countries was similar in countries like Russia and Brazil, where population growth is low, but there is a big difference in places like Pakistan and Nigeria.

The communique set the goal of raising GDP per capita to the level of a moderately developed country – a vague goal that, yet again, leaves room for flexibility. With its eyes set on becoming the world’s largest economy, can this goal be achieved in the near future? Maybe not.

Over the last two years, trade tensions between China and the US have escalated and hampered trade. The global economic disruption caused by COVID-19 has only made things worse for China this year. The export-heavy nation faced supply chain disruptions in the beginning of the year as it went into strict lockdowns to help contain the virus. As a result, China’s manufacturing output declined -28% in February, even lower than 2008 levels. Despite the pandemic, anti-Chinese rhetoric from parts of Washington grew louder, and blamed China for unleashing the highly infectious coronavirus on the US. Now, the painstakingly negotiated trade deal between the two nations hangs in the balance.

The summary of the next five-year plan includes references to “dual circulation,” a new term coined by Xi Jinping last spring, amid the difficulties of both COVID-19’s global economic disruption and the increasingly hostile economic competition with the US. The term suggests a potentially renewed inward focus for China’s economy going forward. The “domestic cycle” (consisting of internal production and consumption) will be the main focus for the next five-year plan, furthered by the “international cycle” (based on foreign trade and investment). The communique thus includes multiple references to the need to spur domestic demand, but no specific details on how to achieve that goal.

Similarly, there are suggestions of an increased economic opening and reform, but nothing concrete yet. Instead, there are general promises of “new steps in reform and opening” and the development of a “high-standard market system” where market forces determine the allocation of resources. Given that a “decisive role” for market forces was first promised back in 2013, the major shift in paradigm is yet to be actively seen.

As Washington moves to cut off Chinese firms like Huawei from access to key Western technologies, China is pressing even more urgently to develop its own technological foundation. We believe that the trend will continue under any US President. The communique noted that innovation occupies the “core position” in China’s innovation drive and pointed to “self-reliance in science and technology as the strategic support for national development.” On the environmental front, in its commitment to battling climate change, China said it aims to be carbon neutral by 2060. As the world’s biggest source of carbon dioxide, responsible for around 28% of global emissions, this is a step in the right direction. The communique also aims to narrow the rural-urban development gap by boosting urbanisation. Although, most of these goals have been points of focus for the communist party for decades, but very much remains a work in progress.

Despite its economic challenges, China has been the only large economy not facing a recession this year and achieving +4.9% GDP growth. China’s economic recovery since the first quarter of this year has been closely intertwined with its handling of the coronavirus, a pursuit in which it has decisively outperformed the developed world. China understood what it needed to do and executed it well. While China is now starting to reap some of the rewards, investors are faced with the dilemma of how they invest in a country that faces its unique set of political and governance issues. Should investors stick to what they know by investing in domestic companies growing their business exposure in China or perhaps bite the bullet and make direct investments in Chinese stocks?

Comments