Is China facing an economic slowdown?

Thought Leadership

Is China facing an economic slowdown?

Thu 07 Apr 2022

China was the first country to successfully emerge from the initial Covid-19 wave. People were back to the office in 2020 itself, infection rates plummeted and as a result economic growth was stellar, beating all expectations. China emerged as the winner at a time when most western countries were still coming to terms with the Covid -19 pandemic and its repercussions. The last 12 months however, have been an absolute reversal for China.

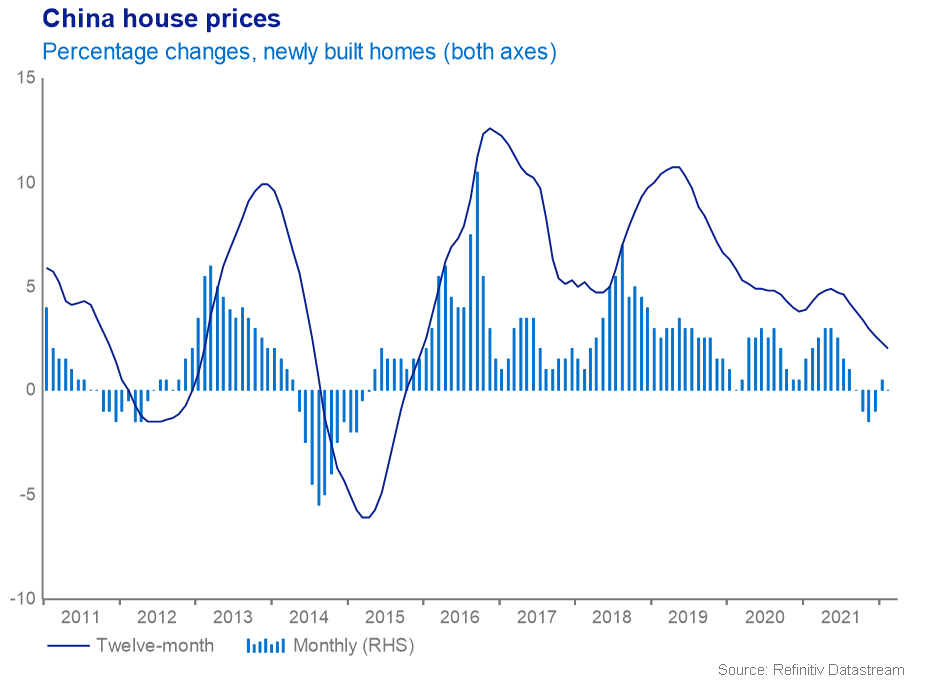

A real estate ‘bubble’ is showing concerning signs of bursting. China’s Evergrande Group has rapidly become Beijing’s biggest corporate threat as it wrestles with debts of more than $300 billion as a result of years of aggressive expansion. But that was just the tip of the iceberg. The total combined debt of China’s major property developers is now estimated at more than $5 trillion. To make matters worse, 20 of the top 30 property firms by sales have breached at least one of three debt limits set by the Chinese government to rein in real estate speculation, meaning they’re unsustainable. With property being a key driver of economic growth ― contributing about 29% to China’s GDP ― any major real estate crash could threaten the entire Chinese economy.

To make matters worse, the Chinese regulator launched a multi-pronged crackdown on its tech, gaming, gig economy, education and cloud computing companies, leaving start-ups and decades-old firms alike operating in a new, uncertain environment. New regulations tackled issues such as high borrowing levels, data privacy and ring fencing businesses to combat anti-competitive behavior by large umbrella corporations.

On the macro side of things, China’s manufacturing and trade heavy sectors have suffered a slowdown amid fallout of Ukraine war and new Covid-19 outbreaks and lockdowns. Factory activity slumped at fastest pace in two years.

There is no denying that a slowdown in China is likely to have knock-on effects across the region, much of which counts the world’s second-largest economy as the biggest source of trade. However, a few points worth mentioning:

- Macro metrics such as retail sales, industrial production and fixed asset investment are slowing down – but this is after a period of exceptional growth, which was never going to be sustainable.

- Most indicators are looming around their pre-Covid levels – signaling strong growth followed by normalization.

- Biggest risk to equities (over the last 6 months) has been regulation of sectors like education, banking, technology, data etc. However – this is bound to reduce investor concerns over the long term.

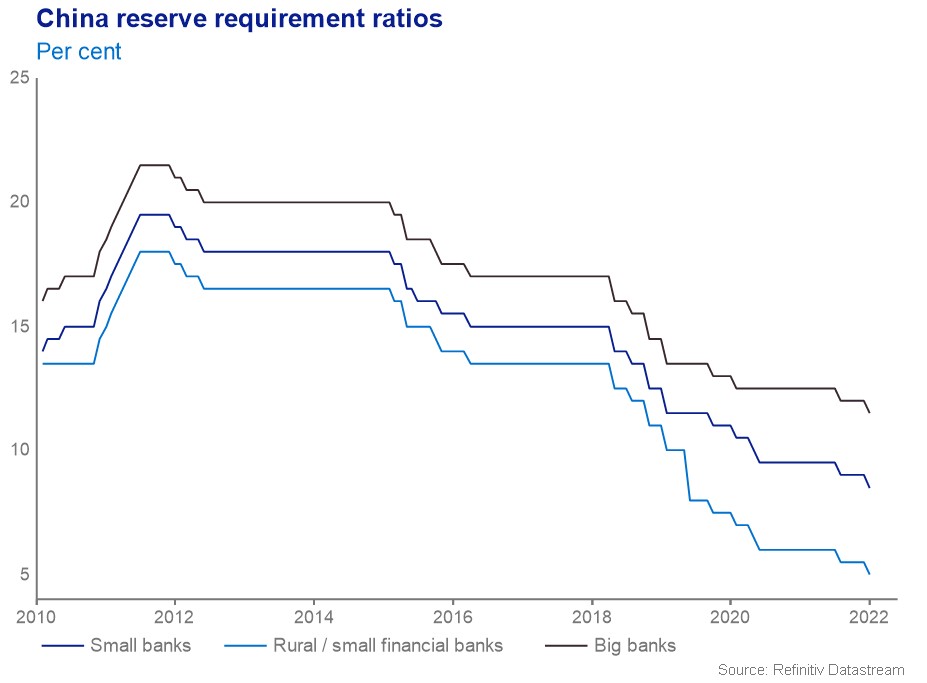

- China’s central bank remains uber accommodative – while the west raises interest rates and tightens policy overall, China is focused on solving its economic issues.

China has faced a slew of challenges to growth in 2021, including a power shortage, shipping delay, Covid-19 outbreaks and a crisis in the real estate sector. The central bank’s rate cuts sends a signal that policy will turn accommodative if need be.