Has the European Commission Been Defeated over Spanish State Aid?

Has the European Commission Been Defeated over Spanish State Aid?

Has the European Commission Been Defeated over Spanish State Aid?

Thu 04 Dec 2014

Analysis of cases T-219/10 Autogrill España SA v Commission and T-399/11 Banco Santander SA and Santusa Holding SL v Commission

Summary

- On 7 November, the General Court of the European Union annuls the European Commission decisions (2009 and 2011) over Spanish State Aid rulings declaring the Spanish tax regime allowing for the deduction of shareholdings in foreign companies to be incompatible with the internal market

- The judgements are very important because they annul the decisions requiring Spain to recover “illegal state aid”

- The judgments have a strong juridical impact because the Court rejected the Commission argument that the Spanish regime is selective. The selectivity being one of the cumulative criteria for classifying a measure as State aid.

- They may undermine the 3rd EU Commission decision of Spanish illegal state aid published on 15 October 2014

Background

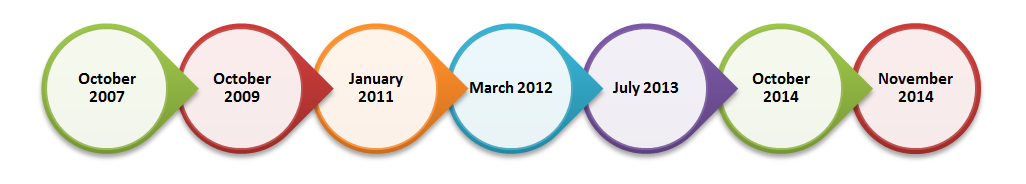

October 2007

By several written questions in 2005 and 2006, members of the European Parliament asked the Commission whether the provision permitting the deduction applicable to shareholdings in foreign companies, as provided by the Spanish law on corporation tax, should be classified as State aid. The Commission responded, in essence, that, according to the information available to it, the Spanish regime did not constitute State aid.

Nevertheless, following a complaint by a private operator in that regard, Commission opened in-depth investigation into a Spanish corporate tax law provision (Article 12(5) TRLIS) over concerns that it provided an advantage for Spanish companies acquiring foreign entities. The law provided that a Spanish company could deduct the ‘financial goodwill’ resulting from the acquisition of a shareholding of more than 5% in a foreign company during the 20 years following the acquisition. IP/07/1469

October 2009

Commission decided in relation to acquisitions in EU countries that the scheme amounted to incompatible state aid: It treated more favourably Spanish intra-EU acquisitions as compared to Spanish-Spanish transactions without any objective reason. The Commission kept the investigation open with regard to acquisitions in non-EU countries in order to examine evidence that Spain had committed to provide. IP/09/1601

January 2011

The Commission concluded that the provision amounted to incompatible state aid also as regards (most) extra-EU acquisitions. Spain had argued that the measure was needed to offset obstacles faced in non-EU countries. Legal obstacles would make it impossible to carry out a cross-border business combination. As a consequence of these barriers, Spanish companies investing abroad would be placed in a different situation than the ones investing domestically. However, in its in-depth investigation the Commission could not identify any explicit obstacles in the vast majority of the more relevant non-EU countries whose legislation it examined. Spain was asked to repeal the provision for acquisitions outside the EU and to recover any aid granted except for those cases where legitimate expectations exist. IP/11/26

March 2012

Spanish authorities adopted a new binding administrative interpretation which allowed the deduction of financial goodwill deriving from indirect shareholding acquisitions through the acquisition of shareholdings of foreign holding companies. In April 2012, the Spanish authorities informed the Commission of new binding administrative interpretation.

July 2013

Commission opens in-depth investigation into new interpretation allowing tax deductions in connection with the acquisition of indirect shareholdings in foreign companies.

The Commission ordered Spain to stop applying the new administrative interpretation until the Commission has taken a final decision on its compatibility (suspension injunction). IP/13/701

15 October 2014 (IP/14/1159)Commission orders Spain to recover aid granted through amended application of tax scheme for acquisition of indirect shareholdings in foreign companies. On 15 October 2014, the European Commission announced that a new interpretation of a Spanish tax scheme benefitting companies acquiring foreign shareholdings is incompatible with EU state aid rules. The scheme allows companies to deduct the “financial goodwill” arising from the acquisition of indirect shareholdings in foreign companies from their corporate tax base. The Commission has found that the measure provided the beneficiaries with a selective economic advantage which cannot be justified under EU state aid rules, and which they must now repay to the Spanish state.

Consistent administrative practice shows that from 2002 until 2012 this initial scheme, which was the subject of the Commission’s 2009 and 2011 decisions, only applied to direct shareholding acquisitions (first level acquisitions) in non-resident operating companies. However, in March 2012 the Spanish authorities adopted a new administrative interpretation which allowed the deduction of financial goodwill deriving from indirect shareholding acquisitions through the acquisition of foreign holding companies, thus extending the initial scope of application of the measure.

An indirect shareholding acquisition is the purchase by a company of shareholdings in the equity of a company at second or lower levels through the means of a direct acquisition of shareholdings in a company at first level. By those decisions, the regime established by the Spanish legislation was declared to be incompatible with the internal market and Spain was directed to recover the aid granted.

T-219/10 Autogrill España SA v Commission and T-399/11 Banco Santander SA and Santusa Holding SL v Commission – 7 November 2014

The General Court of the European Union annuls the European Commission decisions declaring the Spanish tax regime allowing for the deduction of shareholdings in foreign companies to be incompatible with the internal market. The Court pointed out that the Commission failed to establish that the Spanish regime was selective, selectivity being one of the cumulative criteria for classifying a measure as State aid. The General Court observes, first of all, that the existence of a derogation from or an exception to a reference framework (in the present cases, the special tax treatment of goodwill on foreign acquisitions as opposed to the general Spanish tax treatment of goodwill) does not, by itself, establish that a measure favours ‘certain undertakings’ for the purposes of EU law.

The General Court of the European Union annuls the European Commission decisions declaring the Spanish tax regime allowing for the deduction of shareholdings in foreign companies to be incompatible with the internal market. The Court pointed out that the Commission failed to establish that the Spanish regime was selective, selectivity being one of the cumulative criteria for classifying a measure as State aid. The General Court observes, first of all, that the existence of a derogation from or an exception to a reference framework (in the present cases, the special tax treatment of goodwill on foreign acquisitions as opposed to the general Spanish tax treatment of goodwill) does not, by itself, establish that a measure favours ‘certain undertakings’ for the purposes of EU law.

The General Court explains that the Spanish regime is not aimed at any particular category of undertakings but a category of economic transactions. Moreover, no category of undertaking from taking advantage of it was excluded, therefore, does not, in fact, restrict the undertakings which can take advantage of it to those which possess sufficient financial resources to do so.

The most important part of the judgements that the General Court rejects the Commission’s argument that the Spanish regime is selective.

The General Court recalls that a measure which may confer an advantage on all undertakings without distinction within the State concerned does not constitute State aid as regards the criterion of selectivity.

What is next?

Today, it is not clear whether the European Commission will appeal the judgements to the ECJ. It is also difficult to predict what impact of these judgments could have on the third European Commission’s decision published on 15 October 2014.

Source: http://curia.europa.eu/jcms/upload/docs/application/pdf/2014-11/cp140145en.pdf

Comments