HMRC’s employer compliance checks make it essential you get your ERS compliance filings correct – Here’s what you need to know for 2017/18 share plan returns

Wed 07 Mar 2018

Problems described as “teething troubles” when the online filing régime for share plan registration and annual returns was introduced in 2014 remain a concern in some cases in 2018. Authorisation codes may go astray in the post, so companies new to the ERS online system need to prepare as soon as possible, especially in relation to new share plan arrangements introduced in 2017/18 and being registered for the first time. HMRC have made a number of changes to the reporting templates since they were new but we are not expecting any fundamental changes to the 2017/18 templates this year. From a risk perspective, HMRC’s focus is firmly on enforcement of ERS filing compliance. Although the ERS filing may seem a mundane, administrative task, it provides HMRC with useful information for comparison purposes against payroll records, deductions claimed for Corporate Tax purposes and self-assessment filings. There are automatic penalties for failures; so companies should ensure ERS filings are completed accurately and align with other associated reporting to HMRC.

The online reporting process in outline

Since April 2014, all share plans (UK tax-advantaged and UK non-tax-advantaged, including overseas plans with UK participants) have had to be registered online with HMRC. This includes both new and existing share plans, even if the plan had previously been approved by HMRC. All tax-advantaged plans and other share arrangements with reportable events prior to 6 April 2017 should have registered (and for SIP, CSOP and SAYE plans, also self-certified) by 6 July 2017. Existing plans don’t need to be re-registered in respect of 2017/18 but an annual compliance return needs to be filed.

6 July is the deadline

The 6 July deadline applies to:

registration of new arrangements, i.e. those established after 5 April 2017; compliance returns for all schemes; and reports of closure events (in addition to their compliance returns). What needs to be registered?

For new share plan arrangements for 2017/18: 1. register the share plans online; 2. self-certify SIP, CSOP and SAYE plans online; and 3. file annual returns online. The filing obligation applies to:

- Enterprise Management Incentive (EMI) plans; Share Incentive Plans (SIPs);

- Save As You Earn (SAYE) schemes; Company Share Option Plans (CSOPs); and

- All other arrangements of the type once reported on form 42, including foreign plans

SIP, SAYE and CSOP have to be self-certified as meeting the requirements of the tax legislation. HMRC undertake compliance checks nationally to verify such statements, so if you are in doubt about the position of your plan we can provide a proactive health-check review for assurance purposes. EMI option grants also have to be notified online (this needs to take place within 92 days of grant or the tax advantages are lost). Once a plan is registered, a unique reference number is issued online: without this the annual filings cannot be made and the company is exposed to penalties and, often more seriously, loss of tax advantages. This unique reference number should be issued 24-48 hours after the plan has been registered online but past experience has shown that it is best to complete registration of new plans well ahead of the 6 July 2018 deadline as registering the plan on the deadline day will result in a late filing. Additional time needs to be built in to the process if you are appointing an agent (or a new agent) to act for you as there is a separate agent authorisation process to complete.

For pre-existing share plans already registered (and certified where relevant):

A return filing is required. The filing deadline for new and existing share plan arrangements (both UK tax-advantaged plans and non-tax-advantaged plans) is 6 July 2018.

What happens if you don’t register your plan(s)?

If you don’t register a new tax-advantaged CSOP, SIP or SAYE share plan before 6 July 2018, the plan may lose all tax advantages. To the extent that existing share plans in place prior to 6 April 2017 were not registered in time last year, tax advantages may already be lost. If this applies, please contact us and we can discuss your specific case. Neither you nor an agent acting for you can file an ERS compliance return for a plan until the registration process has been completed. A first registration plus ERS agent appointment can take up to six weeks to set up.

How to register and self-certify using the ERS online service

To register your plans and arrangements, you need access to HMRC Online Services and PAYE for Employers and it can take 7-10 days to obtain login details. Login details are returned by HMRC by post (this will take longer if HMRC are posting the information to an overseas address). Once you have obtained access you will be guided through the steps in the process.

Action to consider before April 2018:

Frustratingly, it is that very first step, gaining access, which often causes problems. It is therefore very important that you check now that you can access the ERS online portal even if you want an agent to file the return for you.

Things to be aware of

- Even though you are being asked to report online, much of the process is dependent upon authorisation codes sent by post. HMRC will send ERS information by post to the address shown in its records for the company for UK PAYE purposes. You should check now that the address records are up to date.

- You may have outsourced your payroll and if so only your payroll agent may be set up for PAYE access. You will need to contact HMRC to set up a separate employer PAYE access to enable you to report ERS matters.

- You may have a “legacy” employer PAYE login set up but perhaps have since outsourced payroll and no longer have a record of the previous log in details. This is often difficult to resolve with HMRC so if you think you may need to request a new login you should contact HMRC as soon as possible as it is likely to take several weeks for you to gain access to the ERS portal.

- An ERS agent cannot register a plan or enter a plan termination event. Only the company login provides this functionality. An agent can view what has been registered and file returns.

Why is it advisable to register your new share plan(s) well before 6th July 2018?

As much of the process still relies on information being sent by post and problems with the online system still arise from time to time, we recommend that registration is undertaken as soon as possible. Despite lobbying efforts, HMRC still do not make full use of e-mail communication or online authorisation code confirmation. This has led to cases where registration and agent authorisation code letters have been sent to incorrect or unmonitored addresses leading to delays and duplicate requests for codes. ERS correspondence from HMRC is usually marked for the attention of the Company Secretary even where the company does not have such an officer or where the Company Secretary is not the ERS reporting officer for the company. This all increases the risk that such post will not be directed appropriately within a large organisation.

Internationally Mobile Employees (IMEs) need special care

The reporting requirement extends to non-UK based employees who have carried out work duties in the UK during the earning period (generally between award and vest/exercise). Companies must have visibility of overseas employees carrying out work duties in the UK where they participate in equity awards to ensure relevant transactions are reported for ERS purposes. This is a complex area and one where we can provide expert guidance to ensure compliance and avoid potentially significant penalties for materially inaccurate returns (see below). Automatic penalties apply for late filing and incorrectly completed/formatted returns as follows:

- 7 July 2018 – an immediate £100 penalty

- 3 months late – additional £300 penalty

- 6 months late – additional £300 penalty

- 9 months late – additional £10 penalty for each day the return remains outstanding

There is a penalty of up to £5,000 for a material inaccuracy in a return which is not immediately addressed. HMRC’s systems charge penalties automatically and a “reasonable excuse” will be required to appeal any penalty. In some cases penalties have been issued for incorrectly registered plans where returns have not been filed. Any incorrect plan registrations require a nil return to be filed and the plan then deregistered online. Penalties will be issued where returns are not filed (even where this would be a nil return). The situation is similar for plans registered online in advance of any award being made. Once the plan is registered there is an obligation to file returns online every year. If you wish Mazars to assist with your annual ERS return reporting for 2017/18 then we request that you have registered your plan(s) by 30 April 2018. Only the company can register the plan. An ERS agent cannot register a plan for you. We can provide guidance on the registration process as part of our assistance.

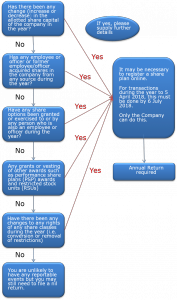

What is a reportable share transaction?

Please see below a flow chart of (non-exhaustive) possible reportable events. If you have any doubts on whether there is a reportable event, please let us know so that we can advise you.

ERS Guidance FAQs

HMRC regularly publish Employment-Related Securities Bulletins which provide information and updates on developments relating to employment-related securities. They maintain ERS FAQs at https://online.hmrc.gov.uk/information/faqs/ers and you can call HMRC ERS enquiries on tel: 03000 585 213 or for IT errors with the online system call 0300 200 3600.

The impact of HMRC’s employer compliance reviews:

HMRC’s national campaign of employer compliance visits is ramping up and checks of ERS filings and share transactions form part of that review so it is more important than ever that ERS filings are accurate. We have seen incidents of employer compliance visits picking up PAYE liabilities and ERS return failures re many events but two typical failures include omitting to tax and report an event once the employee has moved off UK payroll (but remains within the ERS charge) and failing to treat transactions in controlled subsidiary shares as being Readily Convertible Assets (therefore requiring PAYE withholding for taxable events). We have also seen errors picked up by HMRC post M&A transactions where the employer company’s new owners are left regretting not doing more thorough tax due diligence (DD) and have to potentially litigate under tax warranties and indemnities in the sale and purchase agreement regarding the liabilities, interest and penalties relating to share options exercised on the company sale event. (In this regard please contact us if you would like specialist support for tax DD on any corporate transactions.) Our share schemes and employment tax teams can assist with managing employer compliance review checks but we can also help you manage your risk by providing expert support as ERS agent.

How can we help you?

If you would like to appoint Mazars to act as your ERS agent please get in touch with your usual Mazars relationship manager or one of our ERS contacts: Contact details:

South & West: Seb Hassanally Tel: 0117 928 1736 or email Seb.Hassanally@mazars.co.uk

Scotland and North: Rachel Nelson Tel: 0131 313 7987 or email Rachel.Nelson@mazars.co.uk

Midlands and East: Ben Griffin Tel: 01908 257160 or email Ben.Griffin@mazars.co.uk

London and Nationally: Liz Hunter, Head of Share Schemes Tel: 020 7063 4489 or email Liz.Hunter@mazars.co.uk

Please note that Mazars can only assist with the filing of returns and not with plan registration, and HMRC will not be sending out any reminders to companies.

Comments