China’s property sector woes

Thought Leadership

China’s property sector woes

Tue 21 Dec 2021

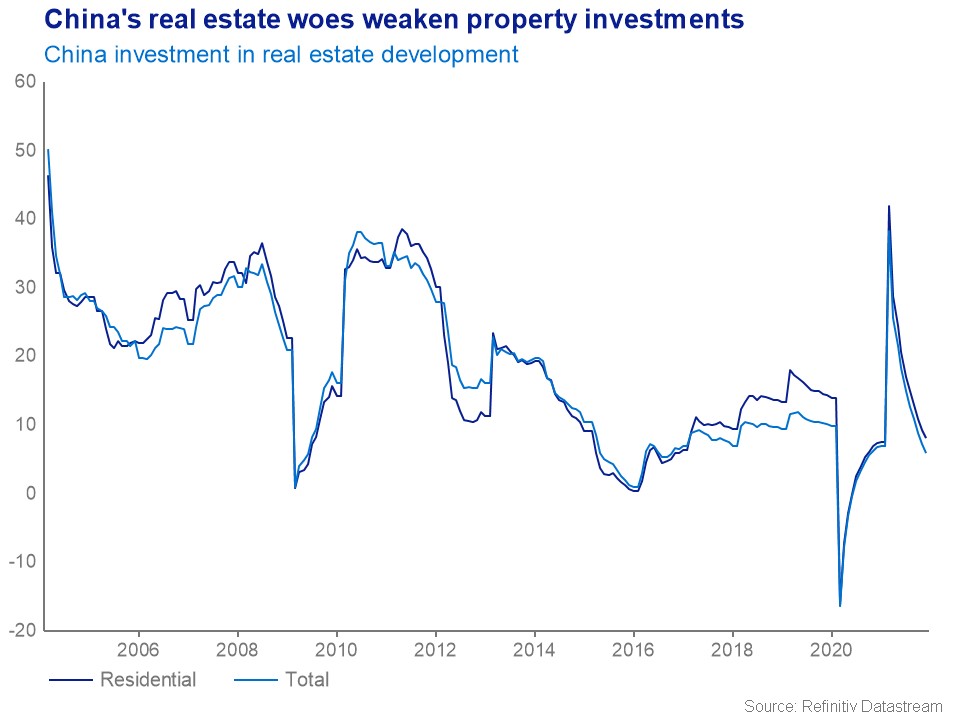

China’s Evergrande Group has rapidly become Beijing’s biggest corporate threat as it wrestles with debts of more than $300 billion as a result of years of aggressive expansion. But that was just the tip of the iceberg. The total combined debt of China’s major property developers is now estimated at more than $5 trillion. To make matters worse, 20 of the top 30 property firms by sales have breached at least one of three debt limits set by the Chinese government to rein in real estate speculation, meaning they’re unsustainable.

With property being a key driver of economic growth ― contributing about 29% to China’s GDP ― any major real estate crash could threaten the entire Chinese economy. Its important to note that China has about 65 million empty homes, which is equivalent to the total number of households in France and the United Kingdom combined, due to a massive building boom and rampant speculation.

Betting on sustained growth, a large proportion of China’s population has money tied up in residential property. According to China’s central bank, 93.6% of urban households owned homes last year, one of the highest rates in the world. The real estate market has continued to expand because investors, developers and home buyers have generally believed that the sector is too crucial to the economy for the government to allow any significant correction.

While new-home sales dropped 32% last month as the Evergrande scandal unnerved investors, huge differences in the way the Chinese real estate market operates could limit the impact of any bubble bursting. One reason for that is that typically a Chinese buyer will only take a 60% bank loan to buy a property. Down payments are therefore 40%, compared to just 3-6% in the US, 5-15% in the UK, and 20% in Germany. So, even if property prices drop 20-30% and there is a rise in defaults, the banking sector can manage.

That’s not to say that some of China’s biggest property developers won’t go under. In recent weeks, Evergrande and others have struggled to offload assets to help repay their debts. Any collapse of a company like Evergrande — which employs more than 200,000 people and indirectly sustains 3 million jobs — is likely to be carefully managed by Beijing to limit the fallout to the wider economy.

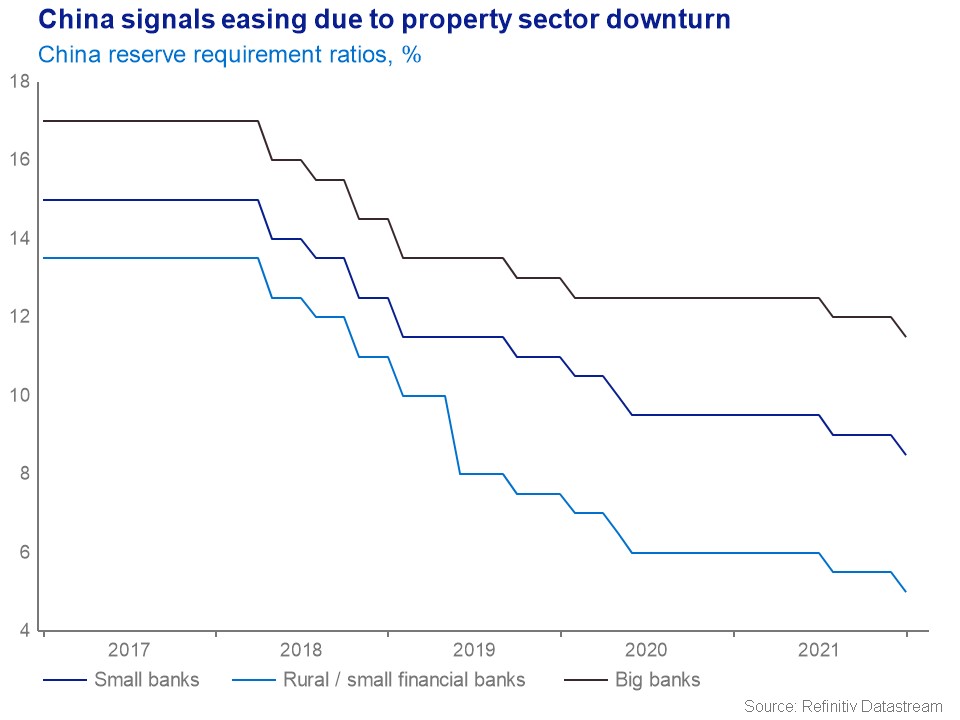

Just this week, China’s central bank cut the reserve requirement ratio for most banks by 0.5%. A move that will unleash 1.2 trillion yuan ($188 billion) for business and household loans. Beijing has been very cautious about intervening in China’s economic recovery during the pandemic. It hasn’t cut the country’s benchmark lending rate since early 2020, and has refrained from flooding the economy with stimulus. But China has faced a slew of challenges to growth in 2021, including a power shortage, shipping delays and a crisis in real estate. The central bank’s ratio cut sends a signal that policy will turn more accommodative on the property sector.