The Trillion Dollar Question - Can We Lose Faith in Central Banks

Thought Leadership

The Trillion Dollar Question – Can We Lose Faith in Central Banks

Tue 05 Nov 2019

Trillion Dollar Question – Can We Lose Faith in Central Banks

However, we would only be touching the surface, inadvertently veering into the sphere of gossip, were we to dismiss such disagreements as mere power plays. In fact, we do not think that investors should care much about ‘who controls the ECB’. Stereotyping, where northern Europeans are presented like grumpy paymasters and southerners as spendthrift Mediterraneans, has seldom any real predictive value when it comes to policy or investment decisions. It was Angela Merkel who acquiesced to QE in 2015 and Dutch Jeroen Dijsselbloem who helped schemes to get poorer countries out of trouble during various stages of the Euro crisis. Conversely, Italy’s Mario Monti has proved himself a champion of very difficult structural reforms.

In her first days as the new ECB central banker, French Christine Lagarde, a former Finance Minister and Managing Director of the IMF, has already found herself in hot water, as her comments on targeting “green” investments through QE have been met resistance from Bundesbank’s Jens Weidmann. Analysing the politics of this disagreement is quite easy. Germany, the strongest member within the ECB, has never had a central banker hold the wheel. The vast amount of Deutsche Marks which Europe’s steam engine ploughed into the creation of the world’s second largest central bank have not been commensurate to the sway German politicians have in making crucial decisions, such as negative interest rates or quantitative easing. Mario Draghi’s departure is the perfect opportunity for German law makers to take back some of the control they begrudgingly ceded, following Mr. Draghi’s game-changing “Whatever It Takes” speech back in 2012.

What is at stake rather, might be the (multi) trillion dollar question of this ten-year plus cycle. With central banks the sole underwriters for this extraordinarily long recovery, what can cause investors to lose faith in them?

Central Banks are the ‘ignition’, not the ‘engine’

In our capitalist system, central banks are viewed as the ‘ignition’ of the car, not necessarily, however, the ‘engine’ of growth. Rather, central bankers are stewards of employment and guardians against inflation.

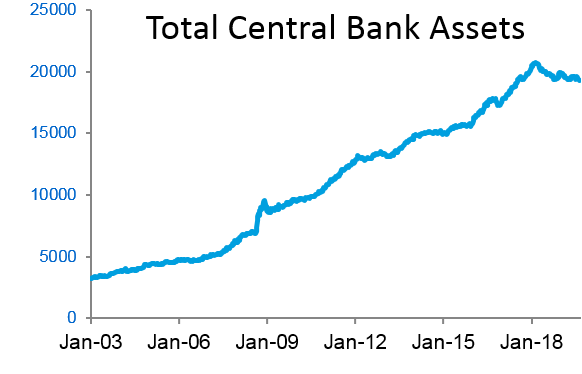

These goals should not be too difficult to achieve in an environment where inflation is persistently low, despite $15tn of printed new wealth by the world’s four largest central banks (US, Europe, UK and Japan) in the past decade and near full-employment conditions in major economies. Additionally, regulatory bodies like the Basel Committee, have created a strict framework around banks, making supervision –the central banker’s day job- much easier.

These goals should not be too difficult to achieve in an environment where inflation is persistently low, despite $15tn of printed new wealth by the world’s four largest central banks (US, Europe, UK and Japan) in the past decade and near full-employment conditions in major economies. Additionally, regulatory bodies like the Basel Committee, have created a strict framework around banks, making supervision –the central banker’s day job- much easier.

Yet, we know from experience that economic fundamentals often deteriorate because of problematic market conditions which has led to loss of trust, devastating for a financial system wholly built on that particular sentiment. The central banks’ ability to print new wealth is paramount to market stability and a necessary feeling of trust which underpins banking. A consumer is less likely to run to the ATM if they feel the central bank will print enough for everyone who will want their deposits back. That feeling keeps investors safe as well. Then buoyed by trust and facilitated by the provision of very cheap money which reduces the opportunity cost, and consequently the risk, of leveraged investments, they proceed with investing in financial assets or business projects. Trust is at the bottom of this pyramid. Ergo, for central banks to achieve their economic goals, they need to foster market stability. They need to go beyond regulation and into the sphere of psychology, to foster trust.

QE is not the panacea

The current bull market is not only the longest in history, but arguably the most “hated” one as well. Since 2008, central banks have been the single biggest factor in both reflating asset prices and fostering growth. However, investors have been sceptical about the ability of ‘money printing’ policies to materially improve economic fundamentals. In the eyes of many institutional investors the so-called ‘slow money’, quantitative easing fixed only short term liquidity issues and restarted frozen credit channels, but could not possibly address longer term structural impediments to growth. Nor could it completely compensate for the damage the fall of Lehman brothers did to the global financial system.

If anything, central bankers should have been able to sit back and relax. They did their job, so it’s time for policy makers to do theirs. Yet recent experience indicates that they will implicitly be called to action where the later cohort is reluctant. After all, it was Ben Bernanke who pioneered QE in the western economies, bringing capitalism back from the brink and proving that in such conditions printing money does not need to be inflationary. It was Mario Draghi who was called upon to save the Euro from the design flaws of policy makers. No wonder then that investors are significantly more attuned to central bank comments rather than those of their political masters. And Mark Carney’s comments that he would slash interest rates have many times soothed investors over Brexit.

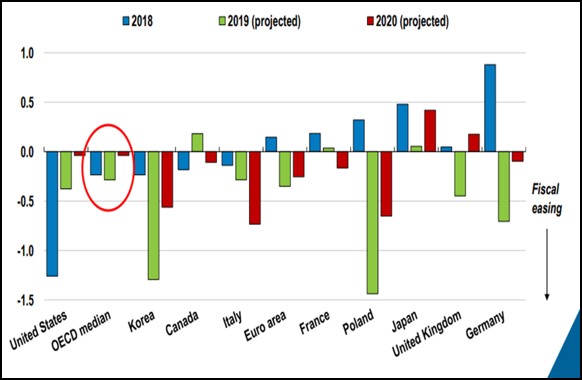

Thus, in the absence of willingness of fiscal policy makers to materially increase fiscal spending, or target it towards longer-term goals, it falls upon central bankers again to foster global growth in a sustainable manner.

Can the trust for central banks be swayed?

Between fiscal and monetary willingness to stimulate or generally manage the economy, the missing element is the willingness of individual investors to take risk following their own analysis.

The logic underpinning Mr. Weidmann’s comments is that the more we intervene, the more we stack the decks one way or another, the more we are indoctrinating investors into a system where they are led, rather than think creatively, causing significant misallocation of assets in the process. If anyone is wondering why $17tn of global bonds have been so overbought that they now have negative yields, has but to contemplate whether the need of policy makers to control market outcomes has forever damaged the ability of investors to take their own risks.

The logic underpinning Ms. Lagarde is that if central banks can do something to support growth, they should go right ahead and do it. But she is fully cognisant of the limits of QE. Printing can reboot the system, but it is still up to policy makers to benefit from the momentum. When they hesitate, the ball’s back in her court to keep the engine from stalling.

Up to this point, investors have had Pavlovian reactions to central bank comments. However, persistently lower growth could render monetary policy useless –at least as a growth tool.

Therein Ms. Lagarde’s conundrum: Failing to support growth might undermine the trust markets have for central banks. But to support growth she often needs to veer into policy making, risking the wrath of her political masters and with it, central bank independence thus still undermining investor confidence.

Have we reached a breaking point where central banks can simply no longer underwrite this recovery? In economic terms it is possible. On the one hand, as the world’s largest money institutions continue to prop up asset prices, a basic element of trust in the system is residual, which means that a recession, insofar as it is not prolonged, may not necessarily turn into a crisis. On the other hand, with interest rates floored and credit channels functioning, there’s little the central bank can do to fight a recession as well.

What does this mean for investors?

If this state of affairs persists, i.e. the failure of fiscal policy makers to effectively pick up the growth baton from their monetary colleagues, we would start to look for potential flags of loss of trust. Markets, for example, may seem unsatisfied with current monetary policies, which happened in the US last year, or altogether ignore accommodative comments by central bankers –which we have not yet observed.

We would also take arguments against very high bond valuations with a pinch of salt. While yields are extraordinarily low versus recent trends and some rebound is probably due, in an environment where interminable financial repression looks like a one way street, bonds bond prices need not crash. Conversely equity value plays may continue to suffer, as markets remain less focused on the efficient allocation of assets and more attuned to policy making.

Comments