Volatility in global stock markets continued last week, but with little direction and significant swings between positive and negative daily returns

Market Updates

Volatility in global stock markets continued last week, but with little direction and significant swings between positive and negative daily returns

Mon 09 Mar 2020

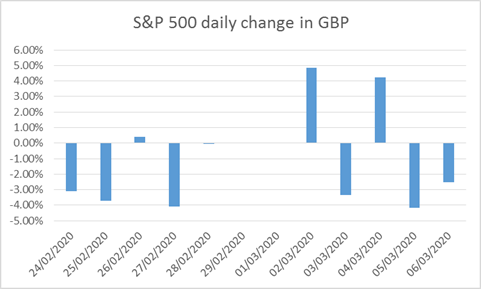

Figure 1. US stock market returns in the last two weeks.

The most significant development last week (other than the continued spread of the Covid 19 virus itself) was the 0.5% emergency rate cut announced by the US Federal Reserve which received a luke warm reception from markets. Over the last ten years we have become accustomed to a well-rehearsed and embedded mechanism where markets respond very positively to the easing of monetary policy be that in the form of interest rate cuts or quantitative easing. That markets did not respond positively to the recent cut is understandable given the combination of supply and demand shocks for goods and services as Governments, companies, and individuals restrict activity to contain the spread of the coronavirus.

The market has been further complicated by Saudi Arabia’s decision to allow the price of oil to fall significantly following disagreement with Russia about production levels. An oil price move of this magnitude will have wide ranging effects, not least on the US shale industry which has taken on significant debt in order to fund its operations. At the time of writing Asian and European stock markets have sustained heavy losses as a result.

Where are we now and what happens next?

Economically speaking the tone has been set. All economic actors are operating on a reasonably rational basis to limit activity to try to contain the spread of the virus, and these actions (some of which are scientifically debateable) are having an immediate and to a degree long lasting effect on economic growth this year. Whether this results in a global recession clearly rests on the duration and extent of the epidemic, an answer to this point being extremely unclear.

An economic downturn is therefore occurring. However it is important to remember that we invest in markets not in economies, and that the two tend not to move in tandem. Put simply, we expect markets to anticipate future economic growth and adjust accordingly, and so with the economic outlook so unclear markets have sold off and volatility continues. There are two catalysts which might cause markets to turn more positive. Firstly, a swift resolution of the epidemic itself and thus a limited economic impact. At this point, this looks unlikely. Secondly, a multi-governmental response through monetary and fiscal measures which compensate economic actors (companies and consumers, and thus markets) for the loss of economic activity. Such a response is very likely to happen, and may well be significant. What is not known is whether markets will feel it is enough to impact asset prices, or indeed what form it may take.

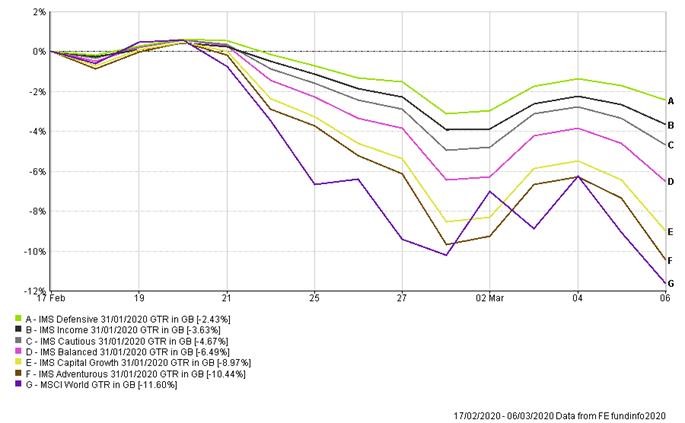

Our portfolios have suffered losses as equity markets have fallen, but have limited these losses to varying degrees by virtue of their respective exposures to non equity asset classes.

Figure 2. Model Portfolio performance since 17th February

At present we plan to retain our current portfolio positioning. As Fig. 1 demonstrates, volatility is extremely pronounced meaning that attempting to time changes in the current market may prove extremely costly, particularly in the event that a significant stimulus is announced which acts to reassure markets.

As ever, should you wish to discuss any aspect of your investment portfolio please do get in touch with me or your usual financial planner.

David Baker, CIO

Comments