Is market optimism justified?

Thought Leadership

Is market optimism justified?

Mon 04 May 2020

Douglas Adams once wrote: “This planet has a problem, which is this: most of the people living on it are unhappy for pretty much of the time. Many solutions were suggested for this problem, but most of these are largely concerned with the movement of small green pieces of paper, which is odd because on the whole it isn’t the small green pieces of paper that are unhappy.”

Last week, the S&P 500 jumped to nearly 3000 points on news that Remdesivir, an Ebola drug that may be used to fight Covid-19, passed some clinical trials with success. So far so good. Then I read the BBC article on the tests themselves. The clinical trials suggested that Remdesivir indeed helps, by cutting the symptoms from 15 days to 11, which is still important because this means it may stop it from developing into something really bad. However, 8% of the patients who received it lost their lives, as opposed to 11% in the control group, which is not statistically significant.

Now I am not a science expert. The US NIAID (National Institute of Allergy and Infectious Diseases) director Anthony Fauci said at an Oval Office meeting Wednesday, the study results were “a very important proof of concept.”, and Mr. Fauci is an honourable man.

Of course I am slightly worried that the Centre for Disease Control (the world famous CDC) is not taking point on this and that the pandemic has been wildly politicised in Washington. But Mr. Fauci is an honourable man.

I’m also generally skeptical of medical advice coming out of the Oval Office these days (DON’T…INJECT….BLEACH). But surely Mr. Fauci is an honourable man.

The conundrum

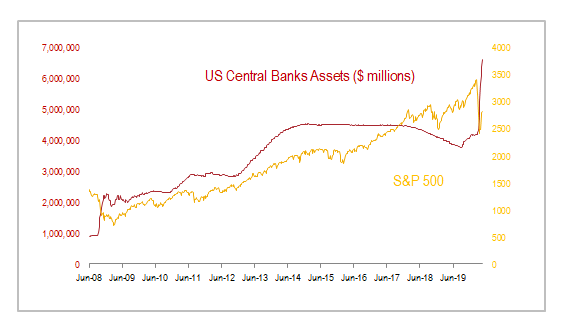

However, I struggle with the idea how news that nothing has changed in my chances of survival from a killer disease that was enough to lock the whole world down, is enough to send the world’s biggest companies trading at eye-watering 22.6x earnings (the average is around 15-16). It seems to me more credible that the market is running on excessive amounts of QE and looking for any good narrative to justify this. After all, the Federal Reserve alone has raised its asset base by $2.9tr since September, from $3.8 to $6.7tr, a 76% rise, and other central banks are following suite. Meanwhile, analysts have moved their FY2020 earnings predictions squarely into FY2021, an FY2021 into FY2022, so we treat 2020 as an aberration with no real long-term repercussions, especially for larger caps.

What investors need to know

And all that is ok, but let’s call a spade a spade, and think of what this means for portfolios and risk assets. So here’s what I do know, and the conversation I would have with my clients. When buying stocks, we are not participating in a company’s earnings any more, at least not this year. We are participating in a Pavlovian game of money printing where we are not trying to guess what will happen to the economy but rather when Pavlov (the central banker) will blow blow his whistle again and flood the market with money. Again, this is not a bad thing (except if one is studying for the CFA in which case my condolences for spending three years reading fat tomes of what is currently as relevant to investment as classical poetry). Since 2009 the MSCI World is up almost three times, beating real economic growth by a lot. Number 1, financial markets provide answers that real economy investments can’t and it’s good to participate in them. More than ever, financial investment is the only game in town.

However, there will be long term repercussions. It is evident that since 2008 Capitalism has gone into survival mode, and solutions aim at saving financial markets, not efficiently allocating assets, which is the purpose of any economic system. Inequalities have risen and are bound to rise more after this Covid episode has passed. The fact that the state will sponsor the real economy as much as it has been sponsoring the financial economy for the next few years, means that there will be less opportunities for new and bright companies to take the place of the redundant and failing ones. The liberal “creative destruction”, the saving grace of capitalism and its “raison d’etre” which helps spread the wealth to those more worthy, is being shut down by indiscriminate government aid to those in need, whether deserving or not. We are trying to solve a big problem by moving green pieces of paper around (money) and this is not a long term solution. If one is not found soon, then Liberal Capitalism will face the same existential problems Communism faced in the 80’s and permatransform to a China-like less efficient and liberal form, clashing with democratic principles and our way of life. So Number 2, know that more political upheaval may be at the end of this, especially by multitudes who don’t have many financial assets.

After mortally wounding Benjamin Graham and value investing (the idea that long term fundamentals will trample market inefficiencies), QE is taking a swing at Harry Markowitz and his portfolio investing principles. The basic idea of asset allocation is still intact of course (buy things that don’t move together to reduce volatility, and benefit from an underlying capitalistic trend which over time sends all risk assets up) which is why we tell clients that now more than ever it is a good thing to do. The problem with all the money printing is that it increases correlations between assets (stocks=up, bonds=up, gold=up) which makes it difficult to find decorrelated assets for portfolios to work better, except for cash and cash-like instruments. Upside volatility of course was never a concern, but we might see (cont.) more bouts of what we experienced in March. So, Number 3, on the one hand everything goes up with turbo-charged QE, which is good and why we should hold portfolios of financial assets, but on the other we are less protected by a spike in volatility, so it is more imperative than ever to have cash pots readily available for clients in drawdowns.

PS. Theory is all well and good, but theories need to change and adapt to our times. In the next few years I’d expect to see a new Graham, a new Markowitz and even a new Keynes and a Friedman if capitalism is to survive inequality, low growth and very high debt. All of us financial professionals should keep an eye on academia for new solutions and start clearing out our libraries…

Great post. It is interesting to read what others

thought and how it relates to them or their clients, as their view could

possibly assist you in the future.

Best regards,

Thomassen Hessellund