Three Burning Questions for Investors

Thought Leadership

Three Burning Questions for Investors

Thu 09 Jul 2020

In the past few weeks, we have been experiencing a flurry of better-than-expected economic data, especially in the US, while global equities remained near the recent high levels they have been trading at for almost a month. A casual read of the situation could be that the markets had run ahead of themselves, and as the economy is now repairing stocks are taking their customary summer breather in anticipation of better data. However, we believe the situation is a bit different.

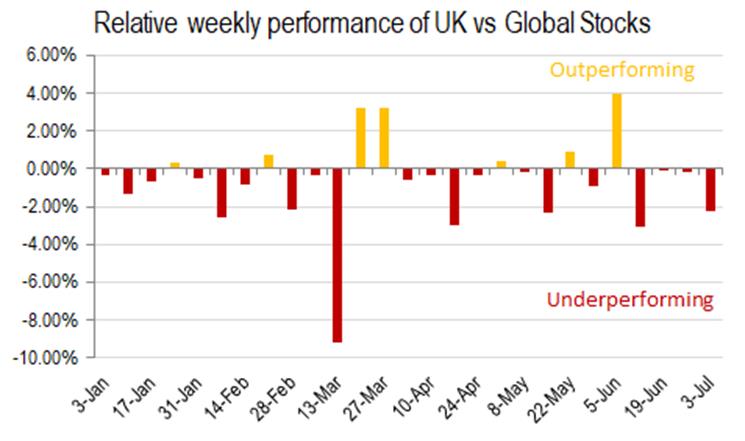

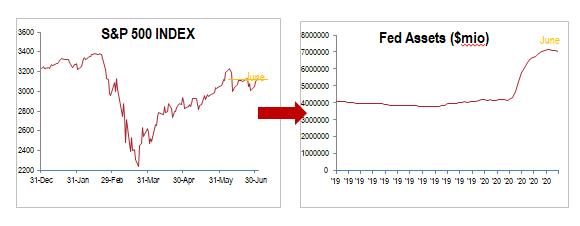

Global stocks peaked in the second week of June and are trading at roughly those levels for a month. Not incidentally, in the same week we observed that Fed balance sheet assets had peaked. Thereafter, the Fed, which had been buying mostly short-term securities it can easily let expire, has reduced its $7.16tr balance sheet by about $160 billion. Thus, as new money stopped flowing, stocks stopped climbing, in line with our longer-term view that asset reflation, not fundamentals, are driving this market. Meanwhile, we observed another bad week for UK risk assets, with UK large caps now 18% below the MSCI World since the beginning of the year – in same currency terms. UK stocks have underperformed their global counterparts in every week but seven, throughout the entire year so far.

We believe that now investors are faced with three key questions that need answering:

- Will the economic recovery happen faster than we expect?

- Have stocks peaked or will the Fed press on with purchases?

- Why are UK stocks underperforming so much?

The jury is still out on all three questions, so all we can offer is our own perspective.

Economy – No “V” just yet

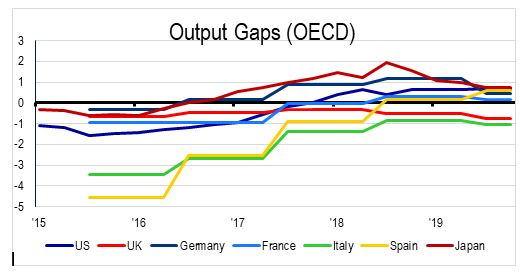

We believe that the economic rebound we saw in June is evidence of pent up demand, not a full swing back up. PMI data suggest that new orders are weak and companies are mostly working off their previous backlogs. Additionally, OECD data suggests a lot of slack in all economies, thus productivity is bound to remain low. Unemployment pressures are bound to increase as government funding for companies is scaled back. While China has performed admirably since the end of its lockdown, we see that production is tepid. Japan, which is China’s closest trading partner and a dependable gauge on the Chinese economy, continues to see a sharp contraction in factory output and orders, suggesting that demand pressures are bound to continue. Global trade conditions were tepid before we entered this crisis, and they are not expected to abate as the US Presidential Election season enters the final stretch. On top of all these, while we acknowledge that the virus narrative has changed for the better, we are also cognisant of the fact that where many policy decisions were made out of panic, now they are made out of Covid-fatigue. None of these can avert a second wave of massive infections, and thus renewed lockdowns. We would thus be very careful with the data, lest we see persisting evidence that the rebound has strong legs.

Fed Takes a Breather – So Do Stocks

For the better part of the last decade, the main driver of demand for risk assets had been cheap money lowering risks and opportunity costs for investors. It is natural for the Federal Reserve to taper purchases at this point. After all, we just witnessed the fastest hike in Fed assets in history. At this point, we see no evidence of a sharp contraction in asset purchases, and neither do the markets, or else we would have certainly witnessed a rout in global stocks. The Fed is very careful to communicate its intentions, and the current message is that “we can do a lot more than this”, an equivalent to the more historic “whatever it takes”. As long as markets don’t see evidence of a “stealth” quantitative tightening, a huge surprise right now, we believe that the drawdown in asset purchases will be short lived. If, by this time next year, company profitability has been restored to long-term trends, it is then that the markets could possibly countenance some further reductions in the Fed Balance Sheet. The $7trm mark, to which we are very close, could be a trigger for traders to watch.

UK Underperformance

There’s no clear narrative or consensus why UK risk assets are shunned by investors. We could be, thus, looking at a confluence of factors. We believe that the two biggest factors are:

a) an aversion to high dividend stocks

b) renewed Brexit worries

Despite low bond yields, investors have been shunning high dividend stocks, mainly due to concerns about dividend viability in 2020. Yields are calculated on last year’s dividend. With many UK companies having taken government furlough money, it stands to reason that a lot of dividends for shareholders may be partly or wholly slashed.

As far as Brexit is concerned, it was in the beginning of the crisis the expectation of investors that it would again be deferred until the European continent was stabilised. Investors, who are now more risk averse than in January are extra careful.

There are of course additional factors in play. The UK has seen the highest Covid infection rate in the world, with policy subject to a lot of criticism. Additionally, UK indices are heavily weighed by industries that haven’t really performed well during this downturn, like oil, banks and insurance. Finally, the UK economy seems to be suffering a bit more than its global counterparts, partly because it’s more sensitive to the global trade breakdown and partly –or maybe due to trade issues- because it has been experiencing more intense supply chain pressures.

A lot of these factors are transitory, but there are some legitimate long term worries for markets. While Covid will eventually pass, some cyclicals will inevitably rebound at some point, as will the currency when the road to Brexit becomes again clearer and dividends may well be reinstated in 2021, we need to acknowledge that the extent of the damage of this period to the British economy is yet to be accounted for, and thus those more long-term investors could wait for a significant period before they decide to up their weights in the UK again.

Comments