Equities still an opportunity?

Equities still an opportunity?

Mon 08 Jul 2019

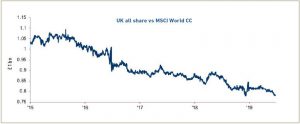

- According to data from the Financial Times and Bloomberg, investors have withdrawn more than £20bn from UK equity funds since the Brexit referendum. The number dwarves the £4bn estimated net inflows from ETFs during the same period.

- Outflows from funds and inflows from ETFs suggest that the “slow money” is moving away from UK equities, leaving more room for speculative investors. The main characteristic of the latter is that they are likely to withdraw quickly, either following very good or very bad returns. Conversely, the former is invested for the long run and tends to add to stability.

- Currently valuations are below average, discounting significant risk despite the fact that UK large-caps only get a third of their earnings from the UK economy.

- In recent times we slightly increased our weight in Sterling ( to which we had a long standing underweight) and took our profits from the position, in fear that a protracted Brexit could end up being no Brexit at all. This would be economically and market positive, but it could hurt our portfolios versus the benchmark. In the last investment committee, following the developments in the Tory Party, we revised our probabilities for a Hard Brexit significantly upwards. We thus reversed that move partly, moving away from UK small caps and into US and Japanese equities, to make sure portfolios are more protected against the probability of a disorderly Brexit.

The Three Things Note: Policy is not uncertain. Traders are.

Alexander the Great was the first of the world’s great conquerors. Originally intent to exact revenge from Persia (modern-day Iran), he turned his adventure into global conquest and exploration. He marched his Greeks from Macedonia to modern-day Turkey, Georgia, Armenia, Syria, Lebanon, Israel, Jordan, Egypt, then back up to Iraq, finally conquering modern-day Iran.

What is the difference between a Mazars CIO and a boiling frog?

As an analyst I hate metaphors. While they are a very useful tool to turn my thorough -but often thoroughly boring- analyses into actual readable pieces, they also almost always convey a false sense of proportion. One of the most successful, yet dangerously misleading narratives I’ve read lately is one that equates investors to slowly […]

The return of loss making IPOs

Is this a bubble or a source of returns for diversified investors? What is the “Uber bet”? We live in a low interest rate super-liquid world, with a lot of money chasing too few opportunities. Overall equity issuance has stagnated over the last few years as CEO’s use buybacks to please existing shareholders, removing equities […]

“All the money is made between the lines”

Understanding Q1 earnings, the framing bias and network effects. Wall Street analysts, paired with the management of big listed firms, often adopt an “under-promise and over-delivery” strategy when it comes to quarterly earnings releases. If earnings forecasts where truly well informed, one would expect on average forecasts to line up with posted results and there […]

Weekly Market Update: US equities reach all-time highs, Global yields fall

Read our full Market Update Week 17 Market Update Last week saw diverging performance in global markets as US equities delivered +1.6% in Sterling terms, however Emerging Market, UK and European equities returned -0.8%, -0.3% and +0.1% respectively. Robust earnings from tech giants and a stronger than expected Q1 annualised growth figure of 3.2% meant […]

China Doll: Our Q2 Economic Outlook

As the world slows down, it looks to China as both a cause and a solution. Will the world’s second largest economy come through? Read our MFP Quarterly Investment Outlook Q2

Weekly Market Update: Equities continue to climb, Pound gains vs Dollar and Yen

Read our full Market Update Week 15 Market Update Global equity markets were mixed last week following a period of strong returns. In Sterling terms global equities were down -0.1%, although in local terms were up +0.5%. In Sterling terms European equities were the only positive region, up +0.2%. US and UK equities were both […]

Weekly Market Update: Stocks rally on dovish Fed

Read our full Market Update Week 5 Market Update Last week was a great week for markets with both real and financial assets posting positive returns. Equities were up in Sterling terms with UK stocks, the best performers of the week up +3.1%. Global stocks returned +2.1% and US stocks returned +2.3%; the S&P 500 is […]

Mazars Quarterly Investment Outlook: 2019 Outlook

Read our full Mazars Quarterly Investment Outlook- Q1 2019 Outlook 2019 Sometimes it appears that the world is getting louder. The Norwegian Sociologist, John Galtung said that if a newspaper came out once every 50 years, it would not report half a century of celebrity gossip and political scandals but rather momentous global changes such […]

Weekly Market Update: China concerns see market volatility

Read our full Market Update Week 50 Market Update Last week the main driver for UK investor returns was the weakness in Sterling, which fell -1.1% vs USD and -0.5% vs EUR. The majority of the drop came on Friday as Theresa May’s inability to win concessions from the EU created further uncertainty about the future […]

Monthly Market Update – December 2018

Read our full Monthly Market Update December 2018 November data indicated that the global economy continues to slow, despite a pick up in the services sector, as trade conditions deteriorate. Risk asset divergence, a theme of the previous quarter, seems to have abated, as US risk asset underperformance closed part of the gap with Europe and […]

Weekly Market Update: Equities sell off on renewed trade war fears

Read our full Market Update Week 49 Market Update US equities sold off significantly last week, down -4.4% in Sterling terms, as trade war concerns weighed on American stocks, erasing the gains made in the previous week. Global equities were down -3.5% in Sterling terms, with all sectors apart from utilities experiencing negative returns. Emerging Market […]

Weekly Market Update: Global stocks rally with US stocks higher after Fed’s comments

Read our full Market Update Week 48 Market Update Last week US equities had already seen a solid rebound, up over 2% for the week in US Dollar terms, when on Wednesday Jerome Powell’s apparent U-turn on interest rates, stating that “they remain just below the broad range of estimates of the level that would […]

Weekly Market Update: Oil prices fall and Tech leads US equities lower

Read our full Market Update Week 47 Market Update Equities fell across the globe last week, with the US suffering the largest decline as technology mega-caps sold off. Facebook is down over 25% year-to-date, suffering from both idiosyncratic factors, such as an ageing user base and political scandals, and sector specific issues such as regulation. Emerging […]

Weekly Market Update: Global stocks continue their rebound while Oil prices drop further and Brexit uncertainty heightens

Read our full Market Update Week 46 Market Update Global stocks continued their rebound this week, with both Global and European equities up +0.3%. Emerging Market equities led the pack, returning +2.5% as the slide in oil prices gave a boost to emerging market currencies. UK Stocks were hit by further Brexit volatility, hardest hit stocks […]

Weekly Market Update: US Equities continue their rebound, oil enters bear market and Democrats win the House

Read our full Market Update Week 45 Market Update US stocks continued their rebound this week, with energy and financials sectors up +1.4% and +1.5%, while the tech sector suffered as Amazon and Apple saw big falls. General Electric also fell to it lowest level since the GFC. Emerging Market equities were down -2.4% in Sterling […]

Is it time for a value comeback?

In recent years value investors in the US have watched as growth stocks have soared and provided excellent returns to shareholders. Some investors have even begun to call value investing a “dead strategy”. There are two primary schools of thought when it comes to effective stock selection: value and growth investing. There are probably as […]

Weekly Market Update: Equities rally ahead of US midterms

Read our full Market Update Week 44 Market Update Global stocks rebounded this week, with Emerging Market equites soaring over 5% in GBP terms. The S&P 500 was up 1.9% and Japanese equities saw a healthy rebound returning 3.4%. US 10-year Treasury yields rose to 3.22%, but didn’t break through 3.25%, a resistance level investors are […]

Weekly Market Update: Global stocks down for the week, capital flows to US bonds, UK budget contingent on Brexit

Read our full Market Upate Week 43 Market Update Global stocks continued to slide this week, with US stocks leading indices lower, the S&P 500 falling -2.2% in Sterling terms. The NASDAQ lost -3% due to disappointing results from Tech companies and a drop in the Consumer Discretionary sector following a disappointing sales outlook from […]

Mazars Quarterly Investment Outlook: Whatever Happened to the Global Synchronised Cycle?

Read our full Mazars Quarterly Investment Outlook – Q4 2018 Global Divergence In an early 2010 report Morgan Stanley warned that the biggest consequence of the 2008 global financial crisis could be isolationism and the reversal of a 50 year old trend which saw increasingly open borders, open trade and freedom of movement. As each […]

Weekly Market Update: Global equities rebound, US treasury yields pick up, Italy still turbulent

Read our full Market Update Week 42 Market Update US indices rebounded this week, leading the pack with a +1.3% gain after the significant correction that investors have seen in recent weeks. US stocks are climbing as tax cuts have lead to significant EPS growth and many companies, including financials, have beaten earnings estimates. The US […]

Weekly Market Update: Stocks sell off globally on rising bond yields

Read our full Market Update Week 41 Market Update Global indices suffered significant falls last week, down -4.1% in local terms and -4.5% in Sterling terms. US equities led the weak performance, experiencing their biggest losses in 8 months on Wednesday. Technology stocks were particularly affected as market participants reacted badly to rising bond yields. […]

Weekly Markets Update: US Equities reach highs; May’s Chequers plans ambushed

Read our full Market Update Week 38 Market Update UK stocks traded higher with the FTSE 100 edging closer to the 7500 level, closing at 7472 point, up +2.65% for the week. In the US the S&P 500 reached new highs, returning +0.8% in GBP terms. Global stocks were up +1.5% in local terms and +1.6% […]

Weekly Market Update: Markets correct on NAFTA and Tech concerns

Read our full Market Update Week 36 Market Update Equities saw sizeable falls across the board last week, both in local and Sterling terms. UK stocks fell -2.0% with US and Global stocks down -0.7% and -1.5% in GBP. Other areas fared even worse, as European, Japanese and EM equities lost -2.3%, -2.6% and -2.8% […]

Weekly Market Update: Markets rally, Tesla delisting cancelled

Read our full Market Update Week 34 Market Update Last week and Monday was a positive period for risk assets, with global stocks returning +0.7%. EM equities gained the most, up +3.2% in Sterling terms and 4.6% in local terms, buoyed by Donald Trump’s announcement that he is prepared to resume talks with China (although […]

Weekly Market Update: US growth powered by strong retail sales

Read our full Market Update Week 33 Market Update Returns were mixed for equities in local terms as, aside from US equities which made a +0.7% return, all major regions fell. Similarly in Sterling all markets were down bar US and global equities which gained +0.8% and +0.1% respectively. Both European and Japanese markets returned […]

Fork in the Road for Tesla

There has been a lot of coverage of Elon Musk’s musings as to whether he will take Tesla private again, having publically listed the company in 2010. Having shares listed in a company is supposed to bring benefits of increasing the ease of raising capital, while the greater liquidity and heightened corporate governance needed to […]

Why look beyond the US for equity returns?

The US stock market has made some impressive gains year-to-date. In January the S&P 500 reached a record high of 2872.87, with the exchange falling just 10 points short of this figure two weeks ago. Apple also recently made headlines worldwide when it became the first US company to be valued at a staggering $1tn. […]

Weekly Market Update: US sanctions further Turkish instability

Read our full Market Update Week 32 Market Update As the pound continued its decline into last week, in local terms equity markets fell across the board aside from UK equities which made a +0.6% return. In Sterling all markets were up bar European equities, with US and global equities gaining the most with +1.9% […]

Weekly Market Update: Equities rally despite no one liking Facebook’s outlook

Read our full Market Update Week 30 Market Update Japanese and Emerging Market equities lead markets higher last week, gaining +2.6% and +2.2% respectively in Sterling terms. These regions had their best week in more than two months, as China’s stimulus measures buoyed the region. News of an agreement reached between President of the European Commission […]

Weekly Market Update: Global stocks up heading into earnings season

Read our full Market Update Week 28 Market Update Global markets were up last week by +1.4%, despite a mid-week blip as once again Donald Trump increased the stakes against China, threatening tariffs on $200bn worth of exports. US stocks were up +1.9% in Sterling terms, however Emerging Market equities gained the most, up +2.0%. […]

Mazars Quarterly Investment Outlook: Mind The Liquidity

Read our full Mazars Quarterly Investment Outlook-Mind the liquidity A cautionary tale There’s an old story about a man who was marooned on a deserted island. Searching for food and water, he instead found a cave hiding a chest of pirate treasure. No water in sight though. He spent his last few days, next to […]

Weekly Market Update: Oil spikes as US inflation hits Fed target

Read our full Market Update Week 26 Market Update Global equities saw a second straight week of negative performance, down -0.7% in Sterling terms, with all major indices experiencing falls in both local and GBP terms. Once again escalating trade tensions were the prime reason for weak performance, although for the second week running UK stocks […]

How much of the FTSE’s strength is due to currency effects?

Currencies have historically been extremely volatile, and predicting FX movements is recognised as a very difficult and risky strategy. Exchange rates move on several, often unpredictable, macro-economic factors, including differences in interest rates or inflation, geopolitics or due to government intervention such as capital controls. Many funds have exposure to currency risk from investing in […]

Weekly Market Update: Italian populist government calms markets, US populist tariffs re-ignite concerns

Read our full Market Update Week 22 Market Update Markets sold off and yields rose in the first half of the week on fears about repercussions of the Italian President rejecting the populist coalition’s choice of finance minister and attempting to install a technocrat government. There were concerns that a new set of elections would […]

Combustible Commodities, Bruised Banks: Why Brexit isn’t the only headwind for UK equities

Whisper it very quietly, lest we jinx it: UK equities have been on a strong run recently. When was the last time you could say that? Certainly not since Brexit, which has been blamed for the poor performance versus global peers. However looking at the 4 quarters leading up to and including the Brexit vote, […]

Trading Trump

This week I was asked to write 180 words on whether President Trump was a ‘welcome disruptor or market menace’ and how his policies can be factored into investment decisions. Despite becoming tired of the circus surrounding the 45th President of the United States, the question poses an interesting debate. Donald the Disruptor Innovative disruption […]

Weekly Market Update: UK equities benefit from Oil rally

Read our full Market Update Week 19 Market Update Last week saw equity markets retreat in local terms, offsetting the previous week’s gains. Emerging markets sold off the most, falling -2.3% in local terms (-1.8% in GBP) weighed down by a stronger US Dollar and rising US Treasury yields. EM were followed by US equities […]

Mazars Weekly Market Update: Weak UK growth sees Sterling sell-off

Read our full Market Update Week 17 Market Update Global equity markets were flat to positive in local terms last week, however a large sell-off in Sterling due to fading expectations for a rate hike at the next MPC meeting in May meant that returns were positive for UK investors. Global equities returned 1.6%, US […]

Mazars Weekly Market Update: Apple sours market recovery

Read our full Market Update Week 16 Market Update Equity markets saw another week of recovery with positive returns across all regions. Returns for UK investors were boosted by a weak return from Sterling, which sold off 1.75% on a trade weighted basis as Mark Carney, the Governor of the Bank of England, made comments […]

Monthly Market Outlook: April 2018

Read our Monthly Market Update After February ended a run of 11 consecutive months of positive, less volatile returns for equities, March saw risk assets continue to suffer as US bond yields peaked near 3% and fears of a global trade war came closer to fruition, with President Trump placing tariffs on Chinese imports of steel […]

Weekly Market Overview – Despite US assurances, trade war fears still weigh on markets

With the continued escalation of threats of tariffs between the US and China, markets suffered another week of negative returns. Global equities were down -1.0% in Sterling terms, dragged lower by US equities which returned -1.8%. Emerging Market and Japanese equities also suffered, down -1.1% and -1.0% respectively. European equities were relatively unscathed with a […]

Weekly Market Overview – Despite scheduled talks, looming trade war roils markets

Donald Trump’s announcement of around $60bn of tariffs against China due to intellectual property violations saw markets experience large losses, as participants feared an escalating trade war. China is expected to hit back with levies aimed at industries and states where Mr Trump’s supporters are concentrated. Equity falls came despite Congress agreeing a $1.3tn spending […]

Weekly Market Overview – Markets fear Taylorisation of Fed and trade wars

Markets continued their recent rocky period, with two separate events causing unease for investors. The first was Jay Powell’s first congressional testimony on Tuesday where he hinted at a faster pace of interest rate rises and stated a preference for rules based interest rate decisions. For example the Taylor Rule proscribes an interest rate for […]

Weekly Market Overview – Recovery continues despite rates normalisation talk by Fed

The market sell-off at the start of February was largely attributed to fears of rising interest rates in the US, with concerns that planned increases in fiscal stimulus to an already strong economy meant the Fed was getting behind the curve. Last week various members of the FOMC, although notably not the Chair Jay Powell, […]

Bargain Basement Britain

Over the last month global equity markets have sold off; since the 15th of January the MSCI AC World Index has fallen -4.12%, the S&P 500 -4.22% and the Japanese Nikkei -6.0%. The UK market similarly has tumbled with the FTSE 100 plummeting -6.36% over the last 4 weeks1. With stocks cheaper compared to a […]

Weekly Market Overview – Equity markets bounce despite inflation scare

Despite a brief panic on Wednesday when US inflation figures came in higher than expected, stoking fears of accelerated interest rate rises, markets had a strong week across the board following 2 weeks of significant market weakness. US markets were up 4.4% in USD terms, however weakness in the currency meant the return in Sterling […]

Market Comment- Storm in a (bond) Teacup

Last week saw a 3.5% pullback for global equity markets, the first since 2016. One reason is a deterioration in global economic data. The second factor is the Federal Reserve, who’s stronger language on inflation and growth, driven by the corporate tax cuts, has made investors realise that its consensus opinion of 2 rate hikes […]

Weekly Market Overview– Equities fall on rising US yields

Equities suffered their worst week since 2016 and subsequently fell over 4% on Monday as concerns over rising US Government bond yields spilled over into risk assets. As of Monday, US 10Y Treasury yields were at 2.84%, having increased from 2.4% at year end, resulting in a total return of -3.1% over the period. The […]

Markets sell-off at fastest pace since 2011

By David Baker, Chief Investment Officer After a strong start of the year for equity markets, global stocks shed almost 5% of their value on Friday and Monday. US equities are now 6.2% below their highs, turning negative for the year, as are global equities (-6.5% from their highs). The S&P 500 is now trading […]

Equity Storm in a (Bond) Teacup

Last week marked a 3.5% pullback for global equity markets, the first since 2016. The move comes after a very good month, January, during which equities rose to fresh highs, gaining 5.2%, prompted by exuberance related to the US tax reform. However, the arrival of February marked fresh concerns for investors. First and foremost, economists […]

Comments