Dodging The Depression: The Ace in the Hole

Dodging The Depression: The Ace in the Hole

Fri 24 Apr 2020

“Neither a borrower nor a lender be/ For loan oft loses both itself and friend” (Hamlet, Polonius, Act I Scene III).

Going back to normality after the Great Lockdown might not be as much a question of consumer habits, as one might think. Whereas human behaviour is hard to predict as an independent variable, it is much easier to “encourage” a particular direction course of action. “Influence”, a book by Robert Cialini detailing effective sales techniques, affected a generation of sales people and consumers and is proof that behaviour can be “nudged”. Marketing departments, opinion journalism, sales techniques exist on the basis of that belief. Thus if one sees in the news that everyone is cowering at home afraid of a second Coronavirus wave, then they too would follow that behaviour. If, conversely, they see a lot of pictures of people happily eating in restaurants, then consumption might return to normal faster than anticipated. Thus we don’t see behavioural patterns as such a big problem, since governments and companies can always influence them.

To understand the breadth and length of this crisis, we must consider the most important mechanism to stop a recession from becoming a depression: The transmission mechanism of policy from the state to businesses. The determinant factor for the course of the global economy will be how much banks will be able to lend out. Currently banks are facing severe constraints after the 2008 crisis. The can only lend out what money the government gives, plus some of their own, but the latter only to the creditworthy. When government money is not enough, borrowers will ask banks for more. How much and who is considered creditworthy, is not just a technical matter but a political one, often shaped by the narrative around the banking sector.

Why we don’t particularly like banks

There are two ineluctable truths about credit:

One, it’s the lifeblood of the economy. If capitalism is about efficiently allocating resources, credit is the delivery mechanism. Credit is primarily about allocating money from where it’s not that useful (for example savings accounts) to where it is (say starting a business) and banks are one of the two prime operators of that mechanism, the other being the corporate bond market. Banks are more crucial for smaller companies whereas the bond market is a cheaper and much less invasive source of funding which is more applicable to larger companies and funding M&A activity.

Two, as much as we need credit, we never really like the creditor. History is inundated with debt forgiveness cycles, whether it was by law or by straight out persecution of the owners of capital. In fact, it started with the world’s first bankers, the Knights Templar. To protect the travellers going from Europe to visit Jerusalem, after 1118 AD the Templars set up stations throughout the whole route from England to Palestine. A traveller could deposit their money in one station, say the Paris Temple, get a slip of paper (the invention of paper money), and pick up an equivalent amount at another point later on in the line, minus whatever fees. This made the Order very rich and influential, especially after it started lending that money out. In the 14th century, French King Philip the Fair who owed a fortune to the Knights Templar, convinced Pope Boniface to declare “The Poor Fellow Soldiers of Christ and The Temple of Solomon” devil worshipers and wiped them out on Friday 13th 1307 (which is why we still consider Friday 13 “unlucky”), for no other reason that they had amassed too much wealth and thus power during two centuries of banking. The paradigm remained. In the following centuries, Jewish communities (who were allowed to lend money as opposed to Christians who then viewed usury as a mortal sin) were equally persecuted when debts mounted. That Shakespeare hated lenders is self-evident, not just by Polonius’s signature phrase above, but by a whole play, “The Merchant of Venice”, which, considering Shylock’s fate (forced to bequeath his property and convert) , is probably the world’s first #occupywallstreet statement. The Medici, medieval Italian bankers, who put all their wealth to the service and glory of Florence were almost persecuted by the monk Savonarola. That particular incident ended up with Savonarola at the stake, but the tug of war between creditors and lenders continued for centuries.

After the 20th century, credit is a pendulum of banking restrictions. When a financial crisis occurs, the narrative can go one of two ways: “banks are strangling us”, or “banks will save us”. Usually that happens in alternating order. The previous crisis was about the former. This crisis will probably be about the latter.

How banking works

In banking, deposits are used, and often leveraged, for loans. i.e. £100 of deposits frequently become £90 on loans (loan-to deposit-ratio) and also £30-£40 in other forms of investment. The problem is that loans are more long term in nature than deposits, so if there is a bank run (depositors all going for their money at the same time) a bank could not in theory serve them all, as a lot of money has been lent out and borrowers have no obligation to return it. Which is why we created central banks, as lenders of the last resort for commercial banks.

After the crash of 1930, when bank runs happened on a daily basis, US Congress voted for the “Glass-Steagall act”, which severely restricted the ability of banks to lend money. Fiscal policy, Franklin Roosevelt’s “New Deal” rescued the economy, but by itself it could not sustain an economic boom, so just before WWII the US economy was back in the doldrums. After WWII, global reconstruction needs fuelled a boom in manufacturing. A new monetary system, the Bretton Woods stable currency system (all currencies were tied to the dollar and the dollar to gold- the so called “Gold Standard”) ensured stability. The boom lasted for about 25 years until Vietnam and Lyndon Johnson’s Great Society ran the economy into the ground. Richard Nixon tried to revive it by ditching the Gold Standard and printing money, which only brought him inflation.

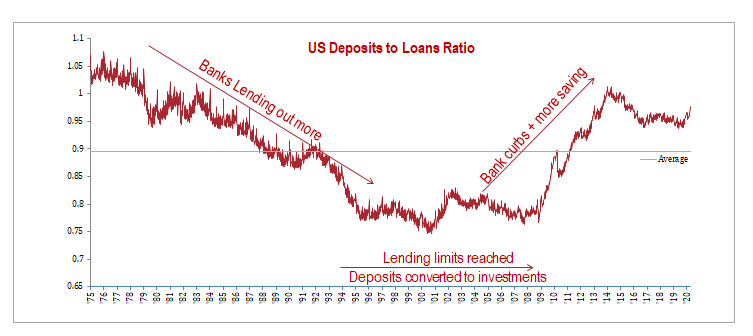

It was not again until the mid 80’s when a mixture of liberal policies and the gradual loosening of “Glass Steagall” across the world, finally brought economic growth back from the dead. This time, not on the merits of organic growth, as western manufacturing was past its peak, but on the basis of credit. Banks were allowed to lend out more and more, and in essence became the prime wealth creators. When Bill Clinton wanted “every American to own their house”, “Glass-Steagall” was fully abolished. Unchecked, and with the Government’s wishes to fight the recession that occurred after the Enron and Worldcom scandals, banks over lent, leading to the 2008 crisis.

After that, it was time to restrict their ability to lend out again, with a set of rules known as “Volcker Rules”, which were really “Glass-Steagal II”. Lending standards tightened and bank proprietary trading desks were handcuffed. Without the ability of banks to fuel a boom, the recovery for the last twelve years was haphazard, just like in the 70’s and the late 30’s.

What now

The IMF predicted that the global economy will shrink 3% this year, the worst economic retrenchment since the 1930’s, with risks on the downside, which makes this the “good scenario”. A lot of smaller companies are in desperate need of cash, but government stimulus is often not enough, or the applicants are not really creditworthy. The real way to prevent mass bankruptcies, which could convert the recession into a crisis of faith and thus a depression, is to loosen those credit standards and allow banks to lend out more, much more, taking risks the state can’t.

But how does one go about it? To lift the heavy chains of Basel III and other regulatory restrictions put in place after 2008 to justify bailouts, one must have public opinion with them. Reversing the picture of the greedy banker who brought the world to their knees in 2008 is not an easy narrative to break. Which is why we have been following many articles suggesting that “it’s now time for banks to pay back their debts from 2008”. How will this happen? Perversely by deregulating them once more. This is the “Ace in the hole” for global policy makers: another round of bank deregulation. It will be a problem for governments in 2026 or 2027 what they do with the next crisis that will, most probably, develop. Crises after all, are about fixing problems today and worrying about consequences tomorrow.

What to look out for

Thus, to see positive economic turning points, investors must be on the lookout not just for virus or consumption related narratives, but for narratives that prepare the growth for a change in banking regulation. How long will that take? The economic data will have to continue to be poor, and unemployment levels will have to rise manifestly before a “demand for banks to step up” becomes more pronounced. If that does happen before the economy takes a critical turn for the worst, then we would become more confident about a V-shaped recovery now, and start thinking about what we should do with credit by 2026.

Comments