Central Bank Spotlight

Central Bank Spotlight

Mon 08 Jul 2019

- In the past few decades, one of the policy decisions that were key for investors was central bank independence. In the past, central banks constituted the arm of the Treasury. Run by top notch economists, their ability to review economic conditions independently has given them the power to reduce economic volatility by making sure that the economy did not overheat, and subsequently a crash could be avoided. After 2008, their role in the global economy became paramount, especially when they circumvented political gridlock and printed an unprecedented amount of money to shore up the financial system. For the past decade they have been the custodians and underwriters of economic stability and growth, as well as architects of one of the longest, most impressive and correlated risk asset rallies in history.

- It would not be an exaggeration to say that investors have looked to the central banks much more than fundamentals for well over a decade. However, this status quo is now coming under threat.

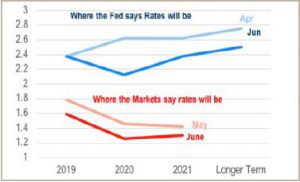

- Their power is not compatible with democratic mandates. In their efforts to shore up the financial system, central banks have taken decisions which hurt savers and put more risk on retirees. Lower structural growth and rising inequalities (exacerbated by central banks printing money mainly for the benefit of holders of financial assets- usually the wealthiest part of the population) have brought populist politics into the mainstream. Populist politicians, elected with a mandate to shake the status quo, target central bankers. As long as inflation is in check they can demand low rates to keep their economy competitive. Lack of a strategic, cooperative and long term perspective means that they can attempt to curb central banker’s attempts to avoid overheating of the economy. This is why candidates with a political background, rather than economists, are now chosen as the heads of the world’s largest central banks. The Fed’s

Jay Powell and the ECB’s -nominated- Christine Lagarde are politicians, more prone to serve political ends and balances, rather than try to avoid an overheating economy. The decade-old safety net of central banks may now be in peril. The risk is clear. Whereas in the wake of 2008 central bankers communicated to curb systemic risks, those more susceptible to please politicians and markets, could exacerbate nationalistic and economic mercantilism, even trigger currency wars.

The year that homework will pay off

The debt ceiling drama-that-wasn’t is squarely behind us. An eleventh-hour deal was signed, averting the wanton default of the biggest economy in the world, and the global risk-free asset, the US Dollar, marking the 79th straight time that the debt ceiling was successfully raised.

Monthly Market Update: Investing money at a time of volatility

Our key theme since the beginning of the year is that the world is a volatile and unpredictable place. To be fair, this could have been our theme every year since 2006 and we would have still hit the mark. But this is not garden-variety volatility.

Quarterly UK Outlook: Q2 2023

The global economy remains unbalanced as the pandemic disrupts global trade, supply chains and international relations. As a result, individual economies diverge and data is unpredictable and volatile.

Monthly Market Update: Volatility and hope

If investors collectively believe in the second coming of QE, then at some point, we should expect a severe market retrenchment. But what if markets are more sanguine than that? What will be the major catalyst, to unleash market forces for risk assets to escape their narrow bands?

Quarterly Investment Newsletter: Winter 2022

The last quarter of the year saw some relief for investors who had been hit from all sides throughout 2022 as markets rallied on the belief that the economy was perhaps showing enough signs of stress to persuade central banks to consider slowing, and then stopping interest rate rises.

Opportunities need swift entry and a lot of patience

Outlooks, our own included, paint quite a grim economic picture at the start of the year. Inflation is really an independent variable and, even if the rate of price rises moderates, prices themselves are set to remain high. Meanwhile, central banks are determined to put the brakes on economic growth in a bid to prevent inflation from becoming entrenched.

A positive message for 2023: The world is rebooting, and that’s good

It is an uncomfortable message that we end the year with, yet a necessary one. Stability should never be seen as the ‘normal’ state of things. And that’s well and truly better for truly long-term investors.

Monthly Market Update: A pandemic that changed the world

Even if we recognise that the world has profoundly changed, we try to analyse it with the eyes of the past. Instead of trying to forecast with the past’s eyes, we need to acknowledge how the present has changed, and develop the right tools to analyse the future properly.

The Outlook 2023: The world we have

Outlooks. The time-honoured financial industry tradition of toiling to write 30-40 pages of annual forecasts promptly binned by April- at the very latest. Yet, the industry gods demand it and deliver we must.

Difficult decisions and difficult truths

It’s bad news for our ‘pivoting’ camp, a word that in the past few months has been grossly and infuriatingly overused. Not only is the Fed speeding up the rate of Quantitative Tightening, but it is also showing no signs that it is ready to change its aggressive tightening policy.

Quarterly Investment Newsletter: Autumn 2022

The third quarter of the year saw markets start to second guess central banks’ resolve to raise interest rates in order to combat inflation. Expectations of a change in monetary policy gathered momentum and caused a rally in global equities of over +11% in a five week period. Alas this proved to be a short- lived bear market rally as central banks, led by the US Federal Reserve, signalled their determination to stay the course with rate rises.

Quarterly Investment Newsletter: Summer 2022

Having been absent for decades, the return of inflation is forcing market analysts to learn how to respond to rising interest rates and squeezes on the real purchasing power of consumers’ disposable income. As interest rates rise, the notion of ‘There Is No Alternative’ is diluted, and the prospects for a slowing economy increase, leaving valuations on risk assets vulnerable despite the recent falls.

Turbulent waters may signal a wave of defaults on the horizon

On the 23rd March 2020, the United Kingdom entered its first official lockdown in an attempt to limit the spread of the COVID-19 virus. The initial uncertainty was catastrophic for the economy and many UK businesses were forced to cease trading as revenues plummeted to zero almost overnight.

Ukraine risks reignite uncertainty over ECB policy

2012 was a year for the financial history books. Europe’s greatest experiment, the common currency area, was moribund after only twelve years of life. The post-Lehman economic convulsions had driven Greece, its weakest economy, bankrupt, and had brought Italy, its most indebted economy, to its knees. Mario Draghi, then Chair of the ECB, and the […]

Inflation momentum will recede. But prices may remain elevated.

There’s a strong possibility we may see the end of the episode soon. But supply chains could take long to mend and overall price levels could remain elevated versus pre-pandemic numbers.

It’s the worst start in 20 years. Here’s why investors should feel fine.

The worst start to the year inn 20 years leaves investors confused. Here's why we are more relaxed about it.

Quarterly Outlook: Sustainomics and a world without QE

2022 is the year where QE (conceivably) ends, and a decade-long Sustainability theme begins. Read our annual outlook.

Investing in a world without QE

Inflation rising may upend a 12-year investment paradigm. Is there life after Quantitative Easing?

A Game of Variants: 5 questions answered

The course of the pandemic in 2022 is not expected to be linear. By and large the pandemic continues to determine economic output and supply chain cohesion. An even more transmissible variant, even if completely covered by current vaccines, could materially increase pressures on consumers, businesses and supply chains.

European Canaries Sighing

As the new german government is being installed, European risk indicators are on the rise. Are markets preparing to challenge the Euro's new status quo?

Quarterly Update: Will the Post-Covid Labour Market ever be the same?

'Work' may never be the same after the pandemic. How might things play out? What do businesses need to know to prepare? Read our quarterly economic update

You can relax. The Fed has no intention to fight inflation (yet).

With inflation pressures coming mostly from the supply side, there is little the Fed can do to curb it. Interest rates are tools best used to cool down the economy during a mature, credit-driven economic boom. They are not designed for a recovering economy and much less for one still under the threat of a pandemic.

Quarterly Outlook: An investor’s inflation and growth playbook

Investing during the past twelve years has been underpinned by a basic principle: market participants have been encouraged to take risks, mainly to offset the trust shock that came with the 2008 financial crisis (GFC). Each time equity prices have fallen significantly, the Federal Reserve, the world’s de facto central bank, would suggest an increase in money printing, or actually go ahead with it if volatility persisted. Bond prices, meanwhile, kept going up, as central banks and pension funds were all too happy to relieve private investors of their bond holdings even at negative yields. Market risk was all but underwritten.

Quarterly Outlook: Inflation: What is it good for?

Inflation expectations rising scared lethargic bond markets and became the most contentious subject of debate in the first three months of the year. Read our outlook to find our position on inflation and the impact on risk assets

What is the difference between a Mazars CIO and a boiling frog?

As an analyst I hate metaphors. While they are a very useful tool to turn my thorough -but often thoroughly boring- analyses into actual readable pieces, they also almost always convey a false sense of proportion. One of the most successful, yet dangerously misleading narratives I’ve read lately is one that equates investors to slowly […]

US election update: Two lessons for investors

The election is almost, but not, over and there are significant lessons for investors.

Another Covid meltdown. What investors should know

For the first time since March, the Coronavirus narrative is truly gripping markets.

Is market optimism justified?

I struggle with the idea how news that nothing has changed in my chances of survival from a killer disease that was enough to lock the whole world down, is enough to send the world’s biggest companies trading at eye-watering 22.6x earnings (the average is around 15-16). It seems to me more credible that the market is running on excessive amounts of QE

Dodging The Depression: The Ace in the Hole

If capitalism is about efficiently allocating resources, credit is the delivery mechanism.

The Great Lockdown – In Perspective

what goals cannot be achieved within the former, might be achieved by investing in stocks and bonds, whose growth is concomitant with the survival of capitalism.

Investing, “in the time of Cholera”

We can comfortably use a phrase that, under other circumstances, would surely risk bringing upon us financial anathema: “This time is different”.

Tinker, Tailor, Soldier… Huawei?

This is a multi-level chess game, touching politics, intelligence and trade, and a move in each field directly affects the other two.

Disparate Emerging Market Returns

The chart below shows the range of returns across top nine countries in the MSCI Emerging Markets index by market capitalisation. Combined they make up 88.6% of the indexas of the end of March. The vast majority of emerging market equity funds use this as their benchmark. The largest constituent in the EM index is […]

The real Champions League winners

Football clubs fall into the ‘Consumer Discretionary’ category of businesses. I’m not entirely sure I would want to tell a Cardiff City fan that their support is discretionary. Regardless, football clubs are a fairly niche investment, with business models significantly different from a regular business. After all they have two measures of success which don’t […]

Could rising oil prices reverse slipping inflation?

Do you have a significant amount of financial assets (bonds, equities) or a significant amount of financial liabilities (loans and mortgages outstanding)? In all likelihood you have a combination of both, which makes the following simple statement moot: people with savings dislike inflation, while those owing money tend to benefit from it. Essentially the real […]

Fear the stimulus more than the trade wars

It feels that Donald Trump’s “trade wars” with China have come to dominate financial headlines as they were considered the main culprit for last week’s stock market correction. However, a closer look indicates that the whole issue is, at this point, essentially noise, both in terms of market indices and the economy. First of all, […]

How populism will end: A Game of Thrones Approach

Game of Thrones is finally ending, with some great lessons about human excesses. After almost 75 hours of watching the world’s most successful show, plus another 20 reading the books, I now find myself not too keen on watching the final episode. I feel that there’s no walking back on the damage done from showrunners […]

Will China Keel Over in 2019?

The key question in 2019 is not Donald Trump or the trade wars between the US and China. The real Gordian knot is China itself. The world’s second largest economy is going through a painful transition, weaning off its dependence on manufacturing and exports and focusing on improving the standard of living for its citizens, […]

Can China’s policy makers really prevent the slowdown?

Over the past few months, ‘trade-wars’ have moved from obscure historic reference into everyday jargon, casually dropped by consumers on sentiment surveys. The US, suffering from chronic trade deficits and increasing imbalances in its co-dependent relationship with China, has set its sights on trying to disrupt this process, a policy that has had an impact […]

How long can Italy withstand the chains of the Euro?

A populist Eurosceptic government, paired with a budget deficit target below 2% and membership of a monetary union is putting a lot of pressure on the Italian economy. The inflated currency strength due to strong countries like Germany sharing the Euro and the inability to use independent monetary policy has cornered Italy into a tough […]

How do you guarantee debt using debt, and so make that debt cheaper?

It sounds like a story from the heady days leading up to the 2008 Global Financial Crisis, and something that will end in disaster. Rating agencies assigning the highest possible rating to an auto maker’s debt which is ‘guaranteed’ on clients paying for leases of its cars (which is essentially debt), with repayment on the […]

Weekly Market Update: BoE keeps rates on hold

Read our full Market Update Week 6 Market Update It was a mixed week for equities, with US stocks ending the week up +1.3%, despite President Trump ruling out a meeting with President Xi before March 1 to strike a trade deal and put trade concerns to rest. It was also a positive week for UK […]

Theresa May’s 157 Brexits – and beyond

The Economist magazine has characterised Brexit “The mother of all messes”. To exit a trade agreement so comprehensive that over the past half century has come to encompass virtually all aspects of the British economy is, by and large, unprecedented. To do so in less than three years, in the midst of political turmoil, is […]

Mazars Quarterly Investment Outlook: 2019 Outlook

Read our full Mazars Quarterly Investment Outlook- Q1 2019 Outlook 2019 Sometimes it appears that the world is getting louder. The Norwegian Sociologist, John Galtung said that if a newspaper came out once every 50 years, it would not report half a century of celebrity gossip and political scandals but rather momentous global changes such […]

Monthly Market Update – December 2018

Read our full Monthly Market Update December 2018 November data indicated that the global economy continues to slow, despite a pick up in the services sector, as trade conditions deteriorate. Risk asset divergence, a theme of the previous quarter, seems to have abated, as US risk asset underperformance closed part of the gap with Europe and […]

Will Donald Trump be happier with the 2019 Fed?

Having regularly declared that he will only hire the best people, Donald Trump has been rather vocal in decrying the actions the Federal Reserve has taken since Jay Powell, his choice for Fed Chair, took office. Mind you he has decried many of his appointees at one point or another, with his Attorney General Jeff […]

Italy’s Greek Moment?

The European commission confirmed that it would be starting the excessive deficit procedure for Italy. Under Eurozone rules, no country is allowed a deficit higher than 3% of its GDP, but the Italian budget proposal challenged the EU directly by assuming significantly higher growth rates. According to Commission Vice President Valdis Dombrovskis “The Commission confirms […]

Weekly Market Update: Global stocks continue their rebound while Oil prices drop further and Brexit uncertainty heightens

Read our full Market Update Week 46 Market Update Global stocks continued their rebound this week, with both Global and European equities up +0.3%. Emerging Market equities led the pack, returning +2.5% as the slide in oil prices gave a boost to emerging market currencies. UK Stocks were hit by further Brexit volatility, hardest hit stocks […]

US Midterm Elections: What is the outlook for markets?

The US goes to the polls today for midterm elections. Every seat of the lower chamber (the House) is up for election (as it is every two years!), while a third of the upper chamber (the Senate) will also be voted on (Senators are elected every six years). For comparison to the UK Parliament, the […]

Angela’s long goodbye and what it means for investors

When Angela Dorothea Merkel became president of her party, the CDU, in 2000, her sights were set on the highest echelons of leadership in Germany. In 2005, she followed Helmut Kohl, her mentor, and Gerhard Schroder by becoming the third post-war leader of a united Germany. Furthermore, she was the the first who grew up […]

Weekly Market Update: Global stocks down for the week, capital flows to US bonds, UK budget contingent on Brexit

Read our full Market Upate Week 43 Market Update Global stocks continued to slide this week, with US stocks leading indices lower, the S&P 500 falling -2.2% in Sterling terms. The NASDAQ lost -3% due to disappointing results from Tech companies and a drop in the Consumer Discretionary sector following a disappointing sales outlook from […]

Mazars Quarterly Investment Outlook: Whatever Happened to the Global Synchronised Cycle?

Read our full Mazars Quarterly Investment Outlook – Q4 2018 Global Divergence In an early 2010 report Morgan Stanley warned that the biggest consequence of the 2008 global financial crisis could be isolationism and the reversal of a 50 year old trend which saw increasingly open borders, open trade and freedom of movement. As each […]

Mazars Wealth Management Investment Newsletter October 2018

Read our full MWM Newsletter October 2018 The global economy continued to grow in the third quarter of 2018 despite a backdrop of concerns over the continued imposition of trade tariffs primarily by the United States. It is apparent that any optimism a compromise between the US and its trading partners (China in particular) can […]

Monthly Market Update – October 2018

Read our full Monthly Market Update October 2018 September data continued to indicate global economic and risk asset divergence, consistent with a mature economic cycle, with USD assets rising as a result of Mr. Trump’s policies. The global economy is also diverging, with the US on a faster expansion path, while Europe and EM are […]

Weekly Market Update: Stocks sell off globally on rising bond yields

Read our full Market Update Week 41 Market Update Global indices suffered significant falls last week, down -4.1% in local terms and -4.5% in Sterling terms. US equities led the weak performance, experiencing their biggest losses in 8 months on Wednesday. Technology stocks were particularly affected as market participants reacted badly to rising bond yields. […]

Weekly Market Update: Fed hikes rates as oil hits year highs

Read our Full Market Update Week 39 Market Update US stocks dropped -0.2% in Sterling terms last week, as the Federal Reserve raised interest rates by 0.25%, with investors concerned about the elimination of the word “accommodative” from the Fed’s policy statement. UK stocks were up +0.3% and UK 10 Year Gilts were up +2.0 […]

Monthly Market Update: EM’s Dollar Turmoil

Read our full Blueprint Sept 2018 August data continued to indicate global economic and risk asset divergence, consistent with a mature economic cycle, with USD assets rising as a result of Mr. Trump’s policies. The global economy is also diverging, with the US on a faster expansion path, while Europe and EM are slowing down. […]

Weekly Market Update: Bank of England and ECB keep rates unchanged

Read our full Market Update Week 37 Market Update Equities rose across the board last week, both in local and Sterling terms. UK stocks gained +0.4% with US and Global stocks up +0.1% and +0.3% in GBP terms. Other areas fared even better, as European and Japanese equities rose +0.8% and +0.6% respectively. However, Emerging […]

How British retailers “gamed” themselves into a corner

When my daughter was first born she had trouble sleeping and hated her cradle. So I used to hold her by to the kitchen fan (new parents take note, this works!) for about 10’, until she was fast asleep. It worked magic every time. Until it didn’t. A few weeks later she didn’t like it […]

Why look beyond the US for equity returns?

The US stock market has made some impressive gains year-to-date. In January the S&P 500 reached a record high of 2872.87, with the exchange falling just 10 points short of this figure two weeks ago. Apple also recently made headlines worldwide when it became the first US company to be valued at a staggering $1tn. […]

European Risks Primer: Richlandia and Poorlandia

The article was originally published in the Money Observer on the 20th July 2018 The potential breakup of the Euro has been a permanently armed grenade under the bed of the global economy for almost two decades. The recent Italian elections driving yields up and the Euro down reminded allocators that European risks have never […]

Unconventional monetary policy increased house prices. Will its withdrawal spark a sell-off?

In March the Bank of England released a working paper titled ‘The distributional impact of monetary policy easing in the UK between 2008 and 2014’. For context, quantitative easing and ultra-low interest rates have been blamed by many commentators for a rise in inequality which has fermented populism in recent years. However the paper found […]

Mazars Quarterly Investment Outlook: Mind The Liquidity

Read our full Mazars Quarterly Investment Outlook-Mind the liquidity A cautionary tale There’s an old story about a man who was marooned on a deserted island. Searching for food and water, he instead found a cave hiding a chest of pirate treasure. No water in sight though. He spent his last few days, next to […]

Monthly Market Update: Markets unable to break out

Read our full Monthly Blueprint July 2018 Month In Review On the face of it, June has not been an exciting month for risk assets. Developed market stocks ended the month roughly in the same place as they started it, while long bond yields were little changed. However, beginning and end figures mask not only […]

Weekly Market Update: BoE’s Chief Economist dissents to put 2018 rate hike on table

Read our full Market Update Week 25 Market Update Global stocks turned negative last week following two weeks of positive performance. Emerging Market equities were the worst hit, falling -2.0% in Sterling terms, as rising trade war fears also weighed on global equities, which were down -0.7%. Japan was also badly hit due to its […]

The difference between a skirmish and a (trade) war

Why geopolitics now matter more In the past few years, investors and economies have grown somewhat insensitive to geopolitical surprises. Brexit, for example, did not cause the massive initial shock to either the economy or the stock markets that many analysts had predicted. Neither did Mr. Trump, whose election has sent stocks soaring by more […]

Following recent elections, could Italy give the Euro the boot?

Last year Europe was the darling of equity investors, as strong growth and improving sentiment throughout the Eurozone meant that it was only behind Emerging Markets in Sterling terms, which had a stellar year in spite of concerns about Trump, over the course of 2017. However, like Emerging Markets, Europe has had a relatively poor […]

Mazars Wealth Management Quarterly Investment Outlook Q2 2018: The new “new normal”

Read our full MWM Quarterly Investment Outlook Q2 2018 The first quarter of 2018 saw a return of market volatility and a reversal of gains from the end of 2017. Despite a strong January, global equities finished the quarter down 2.1% in local currency terms, but 4.7% for UK investors as the Pound continue to […]

Macro of the Week – UK GDP sees marginal improvement

The NIESR GDP growth estimate for the 3 months to March was revised up to 0.2% from 0.1% in February, having been revised down from 0.3%. However the figure is still a reduction from the 0.4% growth seen in Q4 2017. Quarterly growth of 0.2% equates to just 0.8% annual growth. According to Amit Kara, […]

Gender pay and the changing face of the workforce

The gender pay gap is a hot topic in offices across the country as the April deadline for companies to report their pay gap has recently passed. The gender pay gap helps to highlight major demographic changes, in terms of the age and gender, affecting the UK’s labour force. The gender pay gap In an […]

Macro of the Week – John Williams takes over NY Fed

In a move that was expected, John Williams will move from the San Francisco Fed president post to take the same position at the New York Fed. He takes over from William Dudley, who late last year announced he would be leaving by mid-2018. The role comes with vice-chairpersonship of the FOMC – the Fed’s […]

Macro of the Week – US confidence indicators soaring

The recent tumult in equity markets arrived despite robust macroeconomic data in the US, for example the latest earnings season saw 73% of companies beating expectations for earnings. Recent data for consumers and businesses appears to support this view. The NFIB Small Business Optimism index for February rose to 107.6 from 106.9 – the highest […]

Weekly Market Overview – Trade war concerns weigh on markets

Both US equities and the US Dollar fell last week when multinational companies such as Boeing were hit as Donald Trump sought to impose new tariffs on China, pressing China to cut its trade surplus with the US by $10bn. As a result, there is an increased likelihood of a trade war between the worlds […]

Are higher interest rates a necessary evil?

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” Laurence J. Peter When I was studying economics at university (not that long ago) I was taught under ‘neo-classical’ thinking, which had come to pre-eminence in response to the period of ‘stagflation’ in the 1970s. Under stagflation […]

Macro of the Week – US nonfarm payrolls strong

In a reversal of the recent trend where good data is bad news for stocks, and bad data is good news, US equities rallied on Friday after the latest nonfarm payrolls report. The report showed the highest job creation […]

Tariffs: What could Trump do?

Donald Trump roiled markets on Friday by announcing on Twitter: He has since confirmed that he plans to impose tariffs of 25% on steel imports and 10% on aluminium. The move has been widely met with criticism, not just from Democrats but from many members of the Republican Party, including the House Speaker Paul Ryan. […]

Xi Jinping’s Infinite Rule

Things have been looking up for China recently, as market sentiment towards the world’s second largest economy has finally started to take a positive turn. Since 2015, when the country’s stock market sold-off sharply and the Shanghai Composite Index crashed 45% in under two months, investors have understandably been wary of China. Redemptions in Chinese […]

Macro of the Week – US Q4 GDP revised down

US economic growth slowed slightly more than originally expected in Q4. On Wednesday the Commerce Department released revised quarter-on-quarter growth at an annualised rate of 2.5%, down from 2.6%, although this was in line with economists’ estimates. This compares to an annualised growth rate of 3.2% in Q3. The growth in consumer spending (3.8%, the […]

Weekly Market Overview – Markets fear Taylorisation of Fed and trade wars

Markets continued their recent rocky period, with two separate events causing unease for investors. The first was Jay Powell’s first congressional testimony on Tuesday where he hinted at a faster pace of interest rate rises and stated a preference for rules based interest rate decisions. For example the Taylor Rule proscribes an interest rate for […]

Macro of the Week – UK GDP slowing

The UK economy grew more slowly than previously estimated in Q4 2017, increasing by 0.4% quarter-on-quarter according to the second estimate by the ONS. This figure was a 0.1% downgrade from the original estimate. The downward revision was due to slower […]

Black Swans are not so Black (or rare)

A “Black Swan” is a very popular notion in modern stock market commentary, yet the phrase originates from a time before the public listing of stocks. In 16th century London, people used an old Latin quote : “a rare bird in the lands and very much like a black swan“, based on the presumption that […]

Macroeconomic View – French unemployment down

French ILO unemployment dropped unexpectedly from 9.6% to 8.9%. It was further proof of the strength in the French, and subsequently, the European economy. European equities lost 1.5% briefly after the US inflation report was released, with figures higher than expected. The market recovered, but the move is indicative of the factors that affect traders. […]

Macro of the Week – US rate hike still on the cards

The recent sell-off in markets and spike in volatility has so far been met by a wall of silence from the new Fed Chair Jay Powell. On the day of being sworn in, Powell faced a drop of 1,175 […]

Macroeconomic View – German exports accelerating

German exports were weak for the month, up only 0.3%, but are still accelerating year-on-year. Chinese exports were stable, but imports picked up significantly, offsetting last month’s weak data. UK The Markit Services PMI dropped slightly to 53 from 54.2. The Halifax House Price Index year-on-year for the 3 months to January fell from 2.7% […]

Market Comment – Risk on – Redux

After an unusually quiet two-year period, investors were once again reminded that volatility is part and parcel of the investment process. Global stocks suffered their worst week since 2016 and the sixth worst overall week since the recovery began in 2009. More importantly, bond prices also fell, as did other traditionally safer assets such as […]

Monthly Market Outlook: February 2018

Read our Monthly Market Update Global equity markets were positive again, registering a 5.3% performance in January, benefiting from the positive sentiment and the passing of the US tax reform at the end of 2017. The macroeconomic environment was less supportive, however, as some key indicators suggested that global economic momentum was slowing down in […]

Macro of the Week – US wages accelerate

US hiring picked up in January and wages rose at the fastest pace since the GFC. Hourly earnings increased 0.3%, resulting in an unexpected year-on-year increase of 2.9%, up from 2.7% in December (which was also revised up from 2.5%). This was on the back of a nonfarm payrolls increase of 200k, which was upwardly […]

Macroeconomic View – Market Correction

UK Consumer confidence rose in January from -13 to -9, above expectations for the figure to remain flat. Nationwide housing prices year-on-year for January increased to 3.2% from 2.6%, the highest reading since March last year. The BOE’s concern surrounding borrowing was confirmed as consumer credit figures climbed to £1.52bn in December from £1.5bn the […]

Markets sell-off at fastest pace since 2011

By David Baker, Chief Investment Officer After a strong start of the year for equity markets, global stocks shed almost 5% of their value on Friday and Monday. US equities are now 6.2% below their highs, turning negative for the year, as are global equities (-6.5% from their highs). The S&P 500 is now trading […]

Equity Storm in a (Bond) Teacup

Last week marked a 3.5% pullback for global equity markets, the first since 2016. The move comes after a very good month, January, during which equities rose to fresh highs, gaining 5.2%, prompted by exuberance related to the US tax reform. However, the arrival of February marked fresh concerns for investors. First and foremost, economists […]

Macro of the Week – US GDP disappoints

Provisional readings for US Q4 2017 GDP growth came in at 2.6%, slightly below the 3% figure expected by the market. This is an annualised figure and therefore growth for the quarter was actually only 0.1% behind expectations. Strong imports were the main reason for the surprise to the downside, subtracting 1.1% from the growth. […]

Macroeconomic View – Weak US Dollar

Dollar weakness persisted last week as ambiguous messaging from the US Government confused investors. Headline capital goods orders (blue) were robust, however the core capital goods component (red), the less cyclical of the two, has continued to weaken since September. UK Average earnings increased from 2.3% to 2.4% year-on-year for the 3 months to November, […]

Market Comment – Macro headwinds

Last year was very positive, both in terms of stock market and macroeconomic volatility (the volatility of macroeconomic releases). In recent weeks, however, we have noticed a deterioration in macroeconomic releases, especially in the US. Lower inventories and higher imports took a toll on GDP. More detailed data on capital expenditure also shows weakness in […]

Weekly Market Overview – US Dollar slide sees negative equity returns for UK investors

Global equities were mostly positive in local terms last week, however a fall in the US Dollar, combined with Sterling appreciating, meant that returns for UK investors were generally negative. Weak US Dollar performance was largely due to a statement at Davos by US Treasury Secretary Steve Mnuchin being interpreted as suggesting that the US […]

Macro of the Week – German coalition considerations

German elections in November were met with cautious optimism by markets, with Angela Merkel’s CDU party gaining the most seats and seemingly in position to lead a coalition, so maintaining the status-quo in German politics. However negotiations have proven more difficult. The SDP, which claimed the second most seats, initially planned to be the main […]

Comments